Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Trading group Vitol’s UK electricity generation company made profits of more than £600mn last year as it continued to enjoy the benefits from higher prices during the energy crisis.

VPI has reported adjusted annual pre-tax profits of £639.8mn, more than 250 per cent higher than the £177mn made in 2021, before the surge in commodity prices following the war in Ukraine.

It is also up on £555.5mn made in 2022, according to accounts for VPI Holding seen by the Financial Times, illustrating how Vitol has benefited from market disruption since Russia invaded Ukraine two years ago.

Parent company Vitol, the world’s largest commodity trader, made $13bn of net profits in 2023, which were revealed by the FT in April, far ahead of rivals, underlining the group’s powerful position in global energy markets.

Jorge Pikunic, VPI chief executive, said while prices had fallen in 2023, much of the power generated in the year had been sold in advance in 2022, when prices were high due to shortages and concern about gas supplies.

“The operational performance was very, very strong,” he added. “Reliability metrics were even stronger than in 2022 due to the investment we have put into our assets over the past three years.”

But he added that the market had changed “quite significantly” during 2023, with prices falling due to factors including higher output from France’s nuclear power fleet, high levels of wind power and lower demand.

“The high prices resulted in demand reducing and that demand hasn’t come [back] up,” he said. “All that has translated into lower prices. It has also resulted in lower volatility.”

He added: “The years of stable profits for power generation are way behind us. This is an incredibly volatile market [for earnings].”

The adjusted profits exclude the value of contracts VPI buys in advance to hedge supply commitments. When those are included, the company made pre-tax profits of £196.8mn in 2023, down from £1.3bn in 2022.

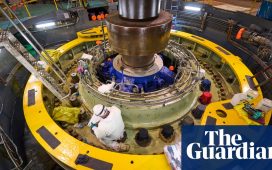

VPI owns four rapid-cycle gas-fired power stations bought from the UK’s Drax in 2020 as well as a gas-fired heat and power plant in Immingham, North Lincolnshire, which supplies steam to next-door oil refineries.

The rapid-cycle gas-fired power stations respond quickly to fluctuations in supply and demand, giving them an important role in the electricity system as they can step in to fill any looming gaps.

That role is likely to become more important as intermittent wind and solar power play a larger role in the electricity system.

Power generators’ profits have come under scrutiny in recent years as high wholesale gas prices feed into consumer bills. UK household energy bills are set to rise 10 per cent on Tuesday due to higher wholesale prices.

VPI has invested £225mn during 2023 to maintain its fleet and build new gas-fired power plants in the UK and Ireland. It also spent £90.2mn buying battery and solar systems in Ireland.

In addition, it is developing plans to attach carbon capture technology to its Immingham plant and stash the emissions under the North Sea, one of several projects that are in line for government support to try to get the nascent technology off the ground.

The company said it is planning to invest up to €450mn in German battery projects over the next three to five years.

VPI was founded in 2013 when Vitol bought the Immingham power station from Phillips 66.