UK retail sales dip in December

Newsflash: retail sales across Great Britain shrank last month, as consumers took a cautious approach to Christmas shopping.

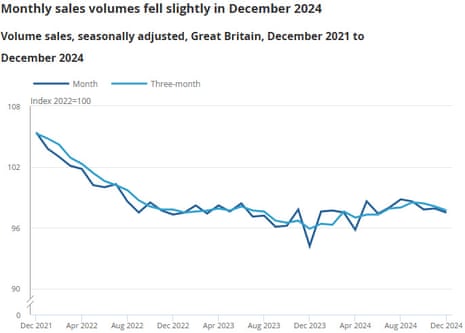

Retail sales volumes dipped by 0.3% month-on-month in December, the Office for National Statistics has reported, missing forecasts of a 0.4% rise.

The ONS reports that sales volumes at supermarkets fell, with food stores sales volumes down 1.9%, which was partly offset by a rise in sales at non-food stores such as clothing shops.

That drop in food sales is surprising, as several retailers have reported strong festive sales. Tesco said it had its biggest ever Christmas, for example.

December’s drop in retail sales followed a small, 0.1%, rise in November.

And over the last three months, the sales volumes (the amount of stuff bought in the shops or online) fell by 0.8% compared the three months to September.

This suggests consumer spending weakened towards the end of last year – several surveys have suggested that confidence declined,

However, there is a wrinkle – the ONS seasonally adjusts its data, to adjust for the impact of Christmas spending, and because Black Friday (29th November this year) fell in its December reporting period this year, which muddied the data.

On a non-seasonally adjusted basis, sales volumes rose by 10.0% in December!

ONS senior statistician Hannah Finselbach says:

“Retail sales fell in December following last month’s slight increase.

“This was driven by a very poor month for food sales, which sank to their lowest level since 2013, with supermarkets particularly affected.

“It was a better month for clothing shops and household goods stores, where retailers reported strong Christmas trading.

“With the timing of Black Friday falling within these latest data, our figures when not adjusted for seasonal spending show overall retail sales grew more strongly than in recent Decembers.”

Key events

Despite December’s drop, retail sales did rise across Britain during 2024 – the first annual increase in three years.

The ONS reports that retail sales volumes rose by 0.7% in 2024, following a fall of 2.9% in 2023 and of 4.1% in 2022.

“Although this marked the first rise in three years, sales volumes have not returned to 2022 levels,” it adds.

Sales fall at specialist food stores, and vaping shops

Today’s retail sales report shows that the drop in food sales (-1.9% on the month) was strongest at supermarkets.

However, sales volumes also fell in specialist food stores, such as butchers and bakers, and alcohol and tobacco stores (including vaping shops), the ONS reports.

UK retail sales dip in December

Newsflash: retail sales across Great Britain shrank last month, as consumers took a cautious approach to Christmas shopping.

Retail sales volumes dipped by 0.3% month-on-month in December, the Office for National Statistics has reported, missing forecasts of a 0.4% rise.

The ONS reports that sales volumes at supermarkets fell, with food stores sales volumes down 1.9%, which was partly offset by a rise in sales at non-food stores such as clothing shops.

That drop in food sales is surprising, as several retailers have reported strong festive sales. Tesco said it had its biggest ever Christmas, for example.

December’s drop in retail sales followed a small, 0.1%, rise in November.

And over the last three months, the sales volumes (the amount of stuff bought in the shops or online) fell by 0.8% compared the three months to September.

This suggests consumer spending weakened towards the end of last year – several surveys have suggested that confidence declined,

However, there is a wrinkle – the ONS seasonally adjusts its data, to adjust for the impact of Christmas spending, and because Black Friday (29th November this year) fell in its December reporting period this year, which muddied the data.

On a non-seasonally adjusted basis, sales volumes rose by 10.0% in December!

ONS senior statistician Hannah Finselbach says:

“Retail sales fell in December following last month’s slight increase.

“This was driven by a very poor month for food sales, which sank to their lowest level since 2013, with supermarkets particularly affected.

“It was a better month for clothing shops and household goods stores, where retailers reported strong Christmas trading.

“With the timing of Black Friday falling within these latest data, our figures when not adjusted for seasonal spending show overall retail sales grew more strongly than in recent Decembers.”

Introduction: China hits 5% growth target

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Along with death and taxes, you can usually rely on China to hit its economic growth targets.

And it’s done it again, with the National Bureau of Statistics of China reporting overnight that China’s economy grew by 5% in 2024. That means it hit Beijing’s official target of “around 5%.”

The target was reached thanks to a burst of activity in the fourth quarter of last year. GDP rose at an annual rate of 5.4% in October-December, beating the market’s expectation, helped by a flurry of stimulus measures powered the economy to meet Beijing’s growth target.

China’s economy shrugged off “a relentless barrage of economic pessimism,” says Stephen Innes, managing partner at SPI Asset Management, to hit Beijing’s growth target, adding:

“This surge was fueled by a vigorous export boom and aggressive stimulus measures that counterbalanced the sluggish domestic demand.

Although slightly outpacing analyst forecasts, this growth fell just shy of the 5.2% expansion seen in 2023, painting a picture of an economy with both promising highs and undeniable challenges”

The NSB also reported that China’s retail sales rose 3.7% year-on-year in December, while industrial output expanded by 6.2% – both faster than expected.