Stay informed with free updates

Simply sign up to the Equities myFT Digest — delivered directly to your inbox.

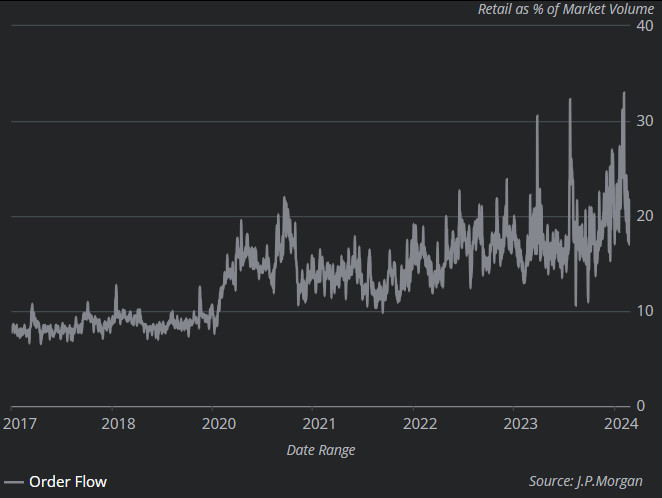

US single-stock buying by retail investors are hitting new records, with the Magnificent Seven accounting for more than 70 per cent of net purchases, according to JPMorgan data.

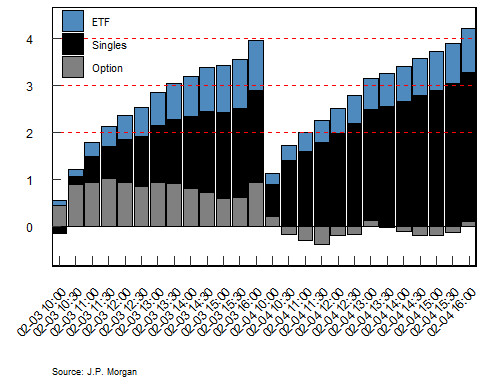

While ETF inflows were “minimal” on Tuesday, single-stock buys exceeded sells by $3.2bn, the broker found. That’s about $1bn more than the second-biggest daily inflow on record, in March 2020.

Per the broker’s latest Retail Radar from JPMorgan’s Emma Wu and team:

Retail traders are on track to break all records. Their daily inflow exceeded $2B twice last week – a level reached only 9 times (as of last Friday) in the past 3 years with 5 times occurring this year after the Inauguration. The momentum continued this Monday despite high uncertainty of tariffs, as their buying flow reached $2B by 1:30pm, ending the day with +$3B. They started strong on Tuesday, breaking the $2B and $3B thresholds within the first 1.5hrs and by 1pm, respectively, which were ~+7.8 sigma above the 1M average for that time of the day, and ending the day with +$4B net imbalance:

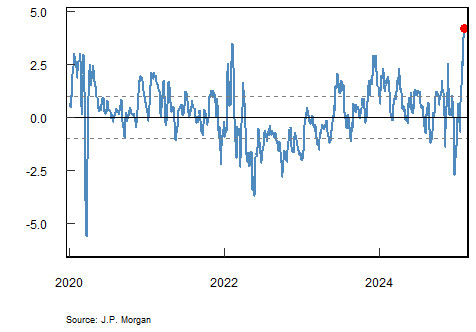

JPMorgan’s retail sentiment score — an AI-powered content crawler — is as euphoric as it has ever been, on Tuesday moving a full point higher than memestonk mania in 2021:

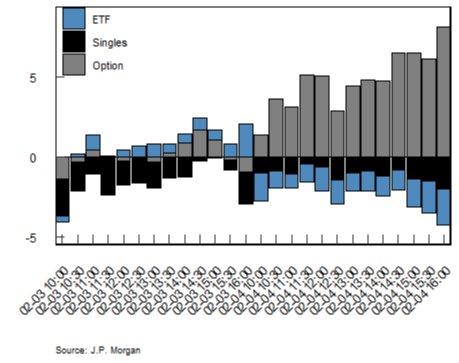

The retailers are accounting for 20 and 30 per cent of total market volume this year, which versus history is fairly high:

You’ll be shocked to learn: also on Tuesday, Institutional investors net-sold $4bn of equities sand bought $8bn of options delta:

What does all this mean for the market? Wu writes:

We find market generally outperforms following extreme retail buying and underperforms after extreme retail selling in short-term. This indicator became particularly evident since 2020, and even more pronounced since mid-2023.

By “short-term”, she means two weeks, so the good vibes can’t be trusted to hold for Nvidia’s results on Feb 26.

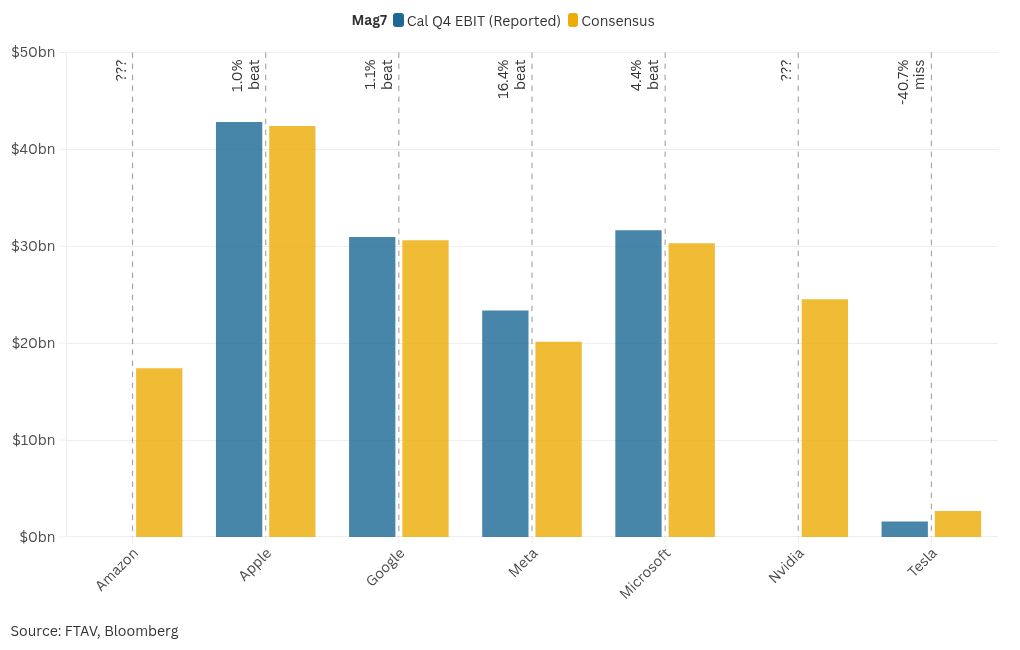

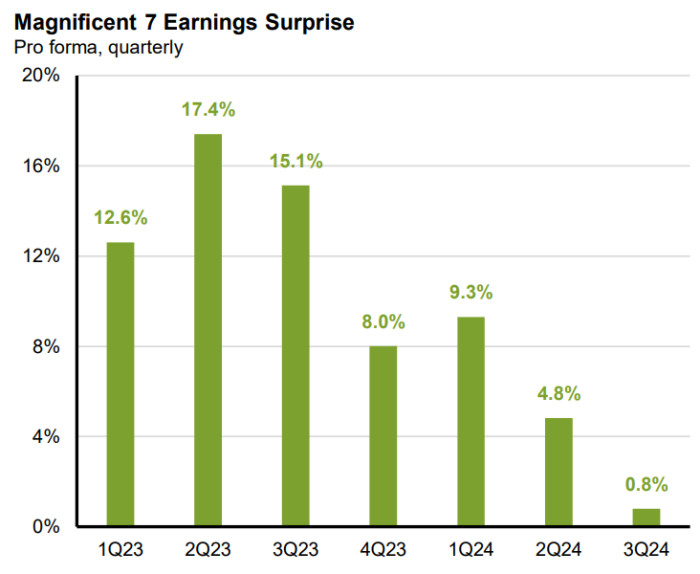

It’s worth noting also that earnings season for the Mag7 has been mixed so far . . .

… which continues a longer term trend of ever-decreasing surprises . . .

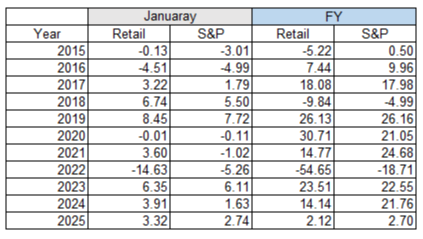

… and for the year-to-date, the average retail punter have been underperforming the S&P 500. Just as they did in 2024, 2022, 2021, 2019, 2018, 2016 and 2015:

Still, someone must be having fun. That’s the main thing.