Gold hits record high over $3,000 amid geopolitical tensions and weakening US dollar

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

It’s been a record-breaking year for gold, as nervous investors have sought out safe-haven assets.

And this morning, the precious metal has hit a fresh all-time high above $3,000 per ounce, driven by escalating geopolitical tensions in the Middle East, trade war fears and the weakening US dollar.

Gold touched $3,017.64 per ounce, as news broke that Israeli military forces have launched widespread strikes on targets across Gaza early today, leading to fears that the shaky ceasefire in the region is over.

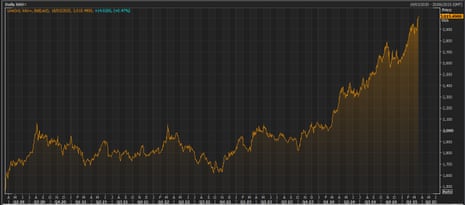

This means gold has climbed by 15% since the start of this year, having ended December at $2,623/ounce, adding to its 27% surge during 2024.

As this chart shows, it has now doubled over the last five years:

The recent weakness of the US dollar has also pushed up the gold price. The greenback is trading near a five-month low against a basket of other currencies, as traders worry that Donald Trump’s enthusiasm for tariffs will trigger a full-blown trade war, that could push the US into recession.

As analysts at Deutshe Bank put it:

Investors continue to rotate away from the US dollar and find perceived safe havens amidst the heightened policy uncertainty.

Linh Tran, market analyst at XS.com, reports that rising tensions in the Middle East and the escalating U.S.-China trade conflict have both driven investors toward gold as a safe investment channel, adding:

These uncertainties have not only increased demand for gold but have also pushed significant capital inflows into the precious metals market, contributing to gold reaching record-high prices.

The agenda

-

9.30am: ONS releases changes to the UK inflation basket

-

10am GMT: ZEW eurozone economic confidence survey

-

12.30pm GMT: US housing starts/building permits data for February

-

1.15pm GMT: US industrial production for February

Key events

The euro is also rising against the US dollar this moring, ahead of a crucial vote in the German parliament about a plan to lift borrowing and spending drastically.

The vote is an important test for Germany’s next chancellor, Friedrich Merz. The plan will release a €500bn infrastructure fund and relax debt rules – currently protected by the constitution – via the outgoing parliament, where parties in favour of the proposals – his conservatives, the Social Democrats (SPD) and the Greens – have the necessary two-thirds majority.

But, Merz has faced criticism for not tying the historic levels of spending planned – as much as €1tn (£840bn) – to economic reforms.

Kit Juckes, currency expert at Société Générale, says:

There’s a lot riding on this morning’s German Bundestag vote on the fiscal package that future Chancellor Merz has put together.

With the CDU/CSU, SPD and Greens all on board and carrying a significant majority onto the vote, there is room for a few rebels to fail to support the motion, but even so, moving the proposal forwards to the Bundesrat could still help the EUR.

The result of the vote is expected around lunchtime…

Pound touches $1.30

Sterling is also having a good morning against the weakening US dollar.

The pound has traded at $1.30 for the first time since early November (just before Donald Trump’s election win sparked a dollar rally).

The dollar is generally weaker again today, due to uncertainty over trade tariffs and concerns that the US economy is weakening.

Expectations that sticky inflation will make it hard for the Bank of England to cut interest rates this year are also supporting the point, Bloomberg reports, adding:

By year-end, traders see the BOE lowering borrowing costs by 51 basis points, less than the 60 basis points expected from the Federal Reserve. The US central bank also meets this week and is forecast to keep rates at 4.5%.

The pound rose above $1.30 for the first time since November on bets interest rates in the UK will stay above those of its main peers this year. https://t.co/xxbApqmFLd

— Bloomberg (@business) March 18, 2025

[51 basis points would imply two rate cuts in the UK this year, with very little chance of a third, while 60bps implies that a third cut in the US is a possibility].

The BoE and the Fed both set interest rates later this week – neither is expected to cut, though.

Gold hits $3,027

Gold is continuing to hit new heights this morning – it’s now trading at $3,027 per ounce.

“In the current environment, every day seems to offer a new catalyst for the gold price,” comments Kathleen Brooks, research director at XTB.

Today, it’s tensions in the Middle East, where the Gaza ceasefire has been shatted as hundreds of people are killed and injured as Israeli military forces hit dozens of targets.

But, growth fears are also fuelling the price surge, she adds:

In uncertain times, central banks and individuals demand gold, while inflation concerns emanating from President Trump’s tariffs and trade war are also boosting the price of gold.

Life above $3,000 per ounce could be the norm for the gold price in 2025, it is already higher by 15% YTD, easily outpacing gains for global equities.

Oil price lifted by supply disruption concerns

Oil is trading near a two-week high this morning, with Brent crude up 1% at $71.73 per barrel.

Matt Britzman, senior equity analyst at Hargreaves Lansdown, reports that concerns over supply disruptions due to ongoing conflicts in the Middle East are lifting oil, adding:

Israel’s large-scale attack on Gaza and President Trump’s threats against Iran have added to the uncertainty, while expectations of increased demand from China, fuelled by stimulus plans and strong economic data, are acting as another tailwind.“

Close Brother dragged into loss by motor finance scandal

In the City, shares in banking group Close Brothers have tumbled after it reported that the UK’s motor finance scandal dragged it into a loss.

Close Brothers reported an operating pre-tax loss of £103m for the six months to 31 January 2025, and a loss after tax ofo £111.8m.

It was dragged into the red by a £165m provision relating to motor finance commissions, the practice where UK lenders made undisclosed payments to car dealers when customers bought cars on credit.

Close Brothers is continuing to not pay a dividend, until the cost of motor finance compensation claims is known.

The company expects to spend £22m this financial year on complaints handling and other operational and legal costs – more than the £10m-£15m it had previously forecast. That increase is due to additional costs associated with an appeal to the Supreme Court over a court of appeal ruling against Close Brothers, which widened the potential scale of the scandal.

Close Brothers’ shares are down 13% in early trading.

Speaking of Lloyds… the bank has apologised after accidentally sending a customer hundreds of pages of information about other clients’ investments.

According to the FT, the customer of its retail investing business, Lloyds Bank Direct Investment, received a package containing bank statements showing the names, addresses and portfolio movements of a dozen other clients. The package also contained information about his own portfolio.

Most of the documents tracked the movements of others’ investments over time, and included one portfolio worth more than £5m.

The astonishing error occured, it seems, after Lloyds printed off the quarterly statements of some randomly chosen customers “to ensure accuracy” before posting the whole lot out.

Unfortunately, a Lloyds staffer opened the collection, and mistakenly posted the entire package to the address on the top of the pile of statements…. More here.

Lloyds staff to learn if they still have a job today

Kalyeena Makortoff

More than 6,000 IT staff at Lloyds Banking Group are due to learn their fate today, more than a month after the high street lender put their jobs under review.

Line managers are due to speak to staff individually this morning, with a company-wide announcement due Tuesday afternoon.

Overall, there is expected to be a net increase in IT vacancies – totalling around 1, 200 according to the banking group, which owns the Lloyds, Halifax and Bank of Scotland brands.

But the problem is how many existing IT staff will be deemed fit to fill them.

Some are expected to be pushed out as a result of a change in job location (with new roles being too far from their home,) their position no longer existing, or requiring more specialised skills.

It is all part of a wider reshuffle related to a major digitisation plan under CEO Charlie Nunn.

However, a reshuffle that puts some staff at risk comes at an awkward time, given how hard existing IT staff feel they’ve been working to help the bank through high-profile outages, that are now under scrutiny by MPs on the Treasury Committee.

Lloyds was among a raft of banks whose customers struggled to log into online bank accounts or suffered payment delays at the end of February.

Overall, MPs are concerned that customers at Britain’s major banks and building societies have suffered the equivalent of more than one month’s worth of IT failures in the last two years.

One of Lloyds’ staff unions, Accord, said it would not be commenting about the IT reshuffle until employees were informed.

Lloyds said:

“Making changes means not only creating new roles and upskilling colleagues but also saying goodbye to talented people who have been part of the group’s success in the past. Where that is the case, we will do everything we can to support them with the changes recently announced.

“We know change can be uncomfortable, but we are excited about the opportunities ahead as we propel forward to achieve our growth ambitions and delivering exceptional customer experiences.”

The Financial Times’s Lex column has a good take on gold today, arguing that it is “unlikely to lose its lustre any time soon”, given its status as protection against risks.

Lex writes:

It is the ultimate shock absorber: against geopolitical maelstroms, inflation and — as a non-yielding asset — lower interest rates.

This trio of latter-day horsemen is galloping across the horizon. Natural orders are being ripped apart as US President Donald Trump toys with ideas like modern-day colonisation, civil-service defenestration and swingeing tariffs. The latter could well tip the US into recession. Since November’s election US gold stockpiles have more than doubled.

AJ Bell: The gold rush continues

We appear to be in the third major bull run in gold since Richard Nixon withdrew America from the gold standard on 15 August 1971, reckons AJ Bell investment director Russ Mould.

He explains:

“The first surge took place in the 1970s, after Nixon’s policy switch that was designed to free up room for US government spending, particularly in Vietnam. Two oil price shocks, in 1973 and 1979, stoked inflation and investors took fright from paper assets and promises, such as government debt, and sought out ‘real’ assets where supply only grew slowly instead.

“The second took place in the early 2000s, as central banks played increasingly fast and easy with monetary policy in response to a series of crises, real or perceived. They ranged from the collapse of the LTCM hedge fund in 1998, the millennium IT bug, the collapse of the technology, media and telecoms bubble and then the Great Financial Crisis and the European Debt Crisis. Record-low interest rates and Quantitative Easing followed, to persuade some investors that central banks and policymakers had lost control, just as it seemed they had in the 1970s.

“The third, and current surge, has its origins in the last decade, as central banks continued to run zero-interest rate policies and did little to sterilise QE. Then came the Covid pandemic, and a crisis for which already-tattered government balance sheets were, in many cases, ill-prepared. Government borrowing surged, especially in the UK and USA, and in the latter the federal debt has continued to grow at an unprecedented pace. The result is that the annual interest bill is now $1.2 trillion, or more than a fifth of the federal tax take, a situation that seems unsustainable. The Trump administration is trying to tackle this head on, with tariffs and efforts to boost America’s manufacturing base, but perhaps gold bugs are sensing another shift in global monetary policy and how the system is managed, especially as inflation remains stubbornly above central banks’ 2% target.

Back when Nixon took the US off the gold standard, bullion was valued at $35 per ounce under the Bretton Woods fixed exchange rate system – a price that proved impossible for the US to stick to, as the money supply increased and other countries swapped their dollar reserves for gold.

Once the US was no longer committed to backing every dollar overseas with gold, at that price, gold began to climb steeply, and by January 1980 it had hit $835 per ounce.

Australian bank ANZ reckons gold has further to climb.

ANZ raised its zero to 3-month gold price forecast to $3,100 per ounce and 6-month forecast to $3,200 per ounce, according to a research note on Tuesday, Reuters reports.

They say:

[For gold] we maintain our bullish view, amid strong tailwinds from escalating geopolitical and trade tensions, easing monetary policy, and strong central bank buying.

They also point out that physical gold has been moving from London to the US, as fears that Donald Trump could impose tariffs on precious metal imports have raised prices States-side:

“As for the gold market, fear of import tariffs has tightened liquidity in the London spot market, as supply flows to the U.S. This has triggered arbitrage trades, with a widening spread between Comex futures and London spot”.

Gold hits record high over $3,000 amid geopolitical tensions and weakening US dollar

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

It’s been a record-breaking year for gold, as nervous investors have sought out safe-haven assets.

And this morning, the precious metal has hit a fresh all-time high above $3,000 per ounce, driven by escalating geopolitical tensions in the Middle East, trade war fears and the weakening US dollar.

Gold touched $3,017.64 per ounce, as news broke that Israeli military forces have launched widespread strikes on targets across Gaza early today, leading to fears that the shaky ceasefire in the region is over.

This means gold has climbed by 15% since the start of this year, having ended December at $2,623/ounce, adding to its 27% surge during 2024.

As this chart shows, it has now doubled over the last five years:

The recent weakness of the US dollar has also pushed up the gold price. The greenback is trading near a five-month low against a basket of other currencies, as traders worry that Donald Trump’s enthusiasm for tariffs will trigger a full-blown trade war, that could push the US into recession.

As analysts at Deutshe Bank put it:

Investors continue to rotate away from the US dollar and find perceived safe havens amidst the heightened policy uncertainty.

Linh Tran, market analyst at XS.com, reports that rising tensions in the Middle East and the escalating U.S.-China trade conflict have both driven investors toward gold as a safe investment channel, adding:

These uncertainties have not only increased demand for gold but have also pushed significant capital inflows into the precious metals market, contributing to gold reaching record-high prices.

The agenda

-

9.30am: ONS releases changes to the UK inflation basket

-

10am GMT: ZEW eurozone economic confidence survey

-

12.30pm GMT: US housing starts/building permits data for February

-

1.15pm GMT: US industrial production for February