- IAG’s first-quarter operating profits nearly tripled to a forecast-beating €198m

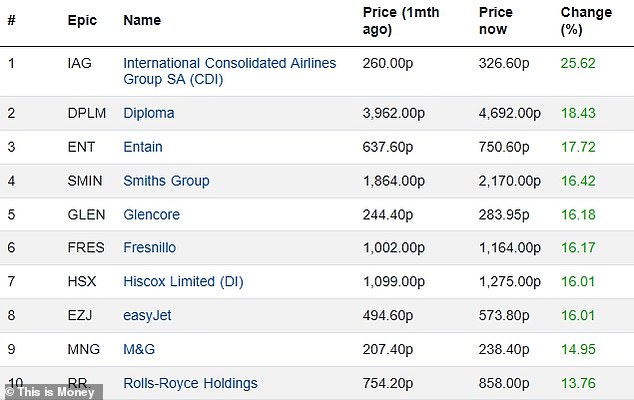

International Airlines Group (IAG) is the best-performing FTSE 100 stock over the past month, spurred by strong results and easing tariffs.

British Airways’ parent company has risen by 25.6 per cent to 326.6p, taking their gains over the last year to around 91 per cent.

Earlier this month, IAG revealed that its operating profits nearly tripled to a forecast-beating €198million in the opening three months of 2025.

The London-based business, which also owns Aer Lingus and Iberia, benefited from lower fuel costs, bumper demand for leisure travel, and favourable foreign exchange movements.

This compensated for the Easter weekend falling in late April, having taken place the prior year much earlier than usual in late March.

IAG also announced plans to purchase 53 new aircraft as part of a UK-US trade deal, with the airplanes due for delivery between 2028 and 2033.

Flying away: Earlier this month, British Airways owner IAG revealed that its operating profits nearly tripled to a forecast-beating €198million in the opening three months of 2025

Early this week, the firm’s shares received a boost after US President Donald Trump postponed plans to slap a 50 per cent tariff on the European Union.

Air travel between the US and the EU has declined since Trump’s inauguration, owing mainly to concerns about the president’s immigration policies.

However, IAG noted in its first-quarter results that demand for premium cabins on its North Atlantic routes had partially offset softer US economy ticket sales.

Another group which has experienced relatively limited impact from trade-related uncertainty is Diploma, whose shares have grown by 18.4 per cent in the last month.

Growth: British Airways’ parent company, International Airlines Group (IAG), is the best-performing FTSE 100 stock over the past month

Diploma shares soared to a record high last week after the products supplier raised its full-year guidance on the back of a robust first-half performance.

It partially credited the result to orders for digital antenna systems and data centres in its Windy City Wire division, as well as rising sales in core building markets.

Not far behind the business is gambling giant Entain (up 17.7 per cent) and explosive detectors maker Smiths Group (up 16.8 per cent); the latter predicted its annual sales would be at the top end of its guidance range.

Meanwhile, two mining giants have both expanded by 16.2 per cent: Glencore, one of the world’s largest mining firms, and Fresnillo, which has reaped the tailwind of surging gold prices.

Geopolitical and economic uncertainty stemming from US tariff measures have driven more investors to back safe-haven assets, such as gold.

Fresnillo shares have been further elevated by silver prices increasing in response to strong demand for the metal’s use in eco-friendly technologies, such as solar panels and electric vehicles.

Other companies among the top ten monthly risers include Hiscox and EasyJet (both up 16 per cent), M&G (up 15 per cent) and Rolls-Royce Holdings (up 13.8 per cent).

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.