UK economic growth smashed forecasts in February, propelled by surprising strength in manufacturing, according to the Office for National Statistics.

GDP expanded by 0.5 per cent for the month, compared to economist forecasts of just 0.1 per cent.

The FTSE 100 is up 0.7 per cent in midday trading. Among the companies with reports and trading updates today are Shein, BP and Heathrow Airport. Read the Friday 11 April Business Live blog below.

> If you are using our app or a third-party site click here to read Business Live

Private equity firm withdraws takeover bid for NIOX Group

Saga’s chairman boosts stake to 27% in company

MPs to be recalled TOMORROW amid signs British Steel nationalised

Morgan Stanley profit beats estimates, boosted by record stock trading

China raises tariffs on US goods to 125%

Scottish school to accept Bitcoin in bid to attract overseas students

Lotus to axe 270 UK jobs due to US tariffs and low sports car demand

PageGroup shares top FTSE 350 fallers

PureTech Health shares top FTSE 350 risers

SMALL CAP MOVERS: Tariff victims emerge after rough week for markets

‘Our base case for 2025 now sees higher inflation and lower growth’

BP debt set to climb by $4bn as energy giant cuts gas output guidance

Hybrids on sale until 2035 – but which types will remain in showrooms?

‘Pleasant surprise’ for the UK stock markets to rise

Peppa Pig toymaker braces for Trump tariff blow

Crisis is not extinguished: Damage Trump has done to stability has not gone away, says ALEX BRUMMER

Breaking:China ups tariffs on US to 125%

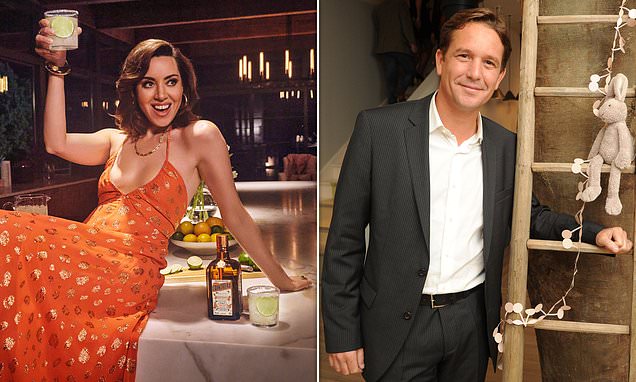

Remy Cointreau chief quits as shares tumble after Trump tariff threats

BP cuts gas output forecast

Shein on course for London IPO after green light from City watchdog

Tesco triggers grocery price war sending shockwaves through the sector

‘Tariffs now represent more than economic headwinds; they’re signals in a global power game’

Tariff carnage could hit Britain’s already battered High Streets, warns the British Retail Consortium

ING: Dollar set to come under further pressure

Market reaction to strong GDP growth ‘understandably muted’ amid trade war threat

Global stock markets under pressure again as US slaps China with 145% tariffs

Shein gets okay for City IPO

Trump turmoil will have a ‘chilling effect’ on UK growth, says deputy Bank of England governor

Bank of England base rate cut in May ‘still looks a good bet’

UK economy beats expectations – but Trump tariff chaos set to weigh

UK GDP grows 0.5% in February