The Trawsfynydd nuclear power station in the Snowdonia national park in Wales closed more than 30 years ago, but local supporters of atomic energy have long hoped that the site would play a key role in an industry revival.

That prospect took a step closer last week after chancellor Jeremy Hunt confirmed the launch of Great British Nuclear, a new body to oversee the rollout of the UK’s ambitious plans for a new fleet of nuclear power stations.

Part of the announcement in the Budget speech included a competition to identify the best of a new generation of mini-reactors built using modular manufacturing techniques, that would attract state funding.

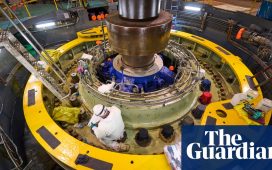

Promoters of these so-called small modular reactors believe the approach would reduce the construction risks that have plagued large nuclear plants, enabling much faster build times.

Depending on the design, a smaller reactor would generate between 50 and 500 megawatts of power, compared with the 3.2 gigawatt output from the only large nuclear part under construction in the UK — Hinkley Point C In Somerset — which is beset by delays and cost overruns.

The government hopes that SMRs will help the UK reach its ambitious target of building 24GW of new nuclear capacity — or a quarter of Britain’s electricity output — by 2050. This compares with 15 per cent at present.

Ministers are anxious to accelerate plans to replace the UK’s fleet of ageing atomic plants, which has dwindled in recent years as older plants were shut down. Four out of five of the operating plants are due to be retired by 2028.

The technology is seen by its supporters as key to helping Britain reach its 2050 net zero emissions target, and the government’s highly ambitious 2035 target to decarbonise the electricity grid. It would also create new, high-skilled engineering and manufacturing jobs.

The Welsh government is backing Trawsfynydd, which generated electricity from 1965 to 1991, as a site for the new SMRs and it is seen as one of the frontrunners to host the first small reactors in Britain.

“We see SMRs as the best option in the near term to generate and sustain employment,” said Alan Raymant, chief executive of Cwmni Egino, the Welsh-government backed agency set up in 2021 to facilitate development at the site. Trawsfynydd, he added, had a “supportive community and a skilled workforce”.

On nearby Anglesey, home of another former nuclear power plant at Wylfa, Virginia Crosbie, the local Conservative MP, is just as keen. Crosbie, who is co-chair of the industry-backed Nuclear Delivery Group, argued that building SMRs would “bring half-a-dozen sites into play that wouldn’t work for large-scale nuclear and would deliver 6 to 8GW at least.”

Industry executives and investors have welcomed the launch of the competition, but stress that given the long regulatory safety approval process for new nuclear technology, time is running short if the UK wants to meet its goals.

Successive Conservative governments have prevaricated over a new nuclear build programme for more than a decade. George Osborne first announced a competition for SMRs more than eight years ago when he was chancellor.

Rolls-Royce, which secured £210mn in government grant funding for its project to build a fleet of 470MW reactors two years ago, has for months been urging ministers to enter formal talks over potential funding models. The company, which makes small nuclear reactors to power the British navy’s submarine fleet, has said it could have its first SMR operational by the early 2030s.

It is the only one of the seven entrants in the SMR competition whose reactor design is already undergoing the rigorous vetting process by the UK nuclear safety watchdog.

Philip Meier, a partner at consultants LEK Consulting, said the UK’s 24GW target by 2050 was achievable if “rapid progress” was made “through the generic design assessment with the original equipment manufacturers . . . and getting reactors up and running in the early 2030s timeframe”.

Opponents, including Tom Burke, co-founder of E3G, a climate think-tank, said the government was set to miss its other target to decarbonise the grid if it used SMRs to help achieve that goal. “Any kind of new nuclear is too late by 2035,” he said.

Six other SMR design submissions are being assessed by the government, ranging from technology from GE Hitachi, an alliance between two civil nuclear industry stalwarts, to start-up Newcleo.

Jon Ball, executive vice-president for market development at GE Hitachi Nuclear Energy, said the UK was attractive because of its internationally-recognised regulatory regime and strong supply chain. GE Hitachi already has agreements to build its SMRs in Canada and Poland. Investors, said Ball, recognised that there was a “benefit to be had from having a technology that is licensed by the UK”.

London-based Newcleo, which is backed by Italy’s Agnelli family, plans to raise €1bn to help fund its expansion plan. It said it could move ahead even without government support.

But others in the industry believe the first SMRs would need government support not unlike the “contracts for difference” widely used to develop green technologies such as offshore wind, which guarantee developers a set price for their output.

Meier said the government should ensure developers can exploit economies of scale and manage risk by awarding contracts to build at least three or four reactors. This would “help to justify setting up the production facilities and the supply chain, and allow you to march down the learning curve”.

Mike Hewitt, chief executive of infrastructure developer IP3, which has sounded out investors about funding an initial rollout of four SMRs, said ministers needed to think about how they would be delivered. “The government has not shown any forward momentum on the project side. They continue to talk to the technology providers.”

Raymant strikes a similar note of urgency. “One of the issues the UK has to be cognisant of is that there is a lot of international interest in this technology.” The competition, he adds, needs to “move at pace and to lead to an actual deployment of reactors”.