It’s lower than the usual borrowing level of roughly 60% in the first half of a fiscal year.

The issuance of sovereign green bonds would be announced in the second half of FY24. The government has already borrowed ₹16,000 crore through such bonds this fiscal year.

The borrowing in the first half is scheduled to be over in 26 weekly tranches of ₹31,000-39,000 crore, the finance ministry said on Wednesday.

The share of borrowing under different maturities will be: 3-year (6.31%), 5-year (11.71%), 7-year (10.25%), 10-year (20.50%), 14-year (17.57%), 30-year (16.10%) and 40-year (17.57%), it added.

“The government has sought to spread out its borrowing plan in such a manner that it doesn’t cause a disruption in the market or cause yields to rise,” said an official.

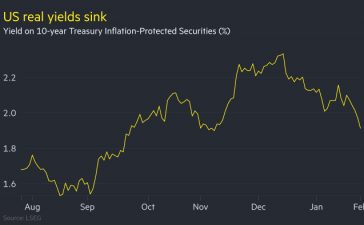

The benchmark 10-year G-sec yield fell 3 basis points on Wednesday to close at 7.29%.

The government will continue to undertake switch operations to smoothen the redemption profile, the ministry said. Bonds worth ₹1.59 lakh crore are due to mature in the first half of this fiscal year and ₹2.81 lakh crore in the second half. Moreover, the government seems to have retained some space for spending in the second half of the fiscal.

ICRA chief economist Aditi Nayar said: “The H1 gross borrowing is less front-ended than earlier years, given the spike in redemptions in H2. With this, the net borrowing will be less unevenly split between the two halves.”

It will again exercise the green-shoe option to retain an additional subscription of up to ₹2,000 crore against each of the securities indicated in the auction notification.

Weekly borrowing through Treasury Bills is expected to be ₹32,000 crore in the first quarter of FY24. Net borrowing through this mode will be ₹1.42 lakh crore during the April-June period, compared with ₹2.40 lakh crore a year before.

There will be issuance of ₹12,000 crore under the bucket of 91 days, ₹12,000 crore under 182 days and ₹8,000 crore under 364 days through each weekly auction during the June quarter.

The Reserve Bank of India (RBI) on Wednesday rejected all bids for 91-day Treasury Bills. The plan was to sell ₹9,000 crore of such papers.

The central bank has fixed the ways and mean advances limit for the first half at ₹1.5 lakh crore to meet temporary mismatches in the government account, the ministry said.