After a strong showing earlier this month that lifted Dogecoin back above $0.20 for the first time in weeks, the meme coin is now flashing early signs of weakness. As of today, Dogecoin is looking like it might break below the $0.2 price level again, having slipped 15% from its recent local high of 0.2581.

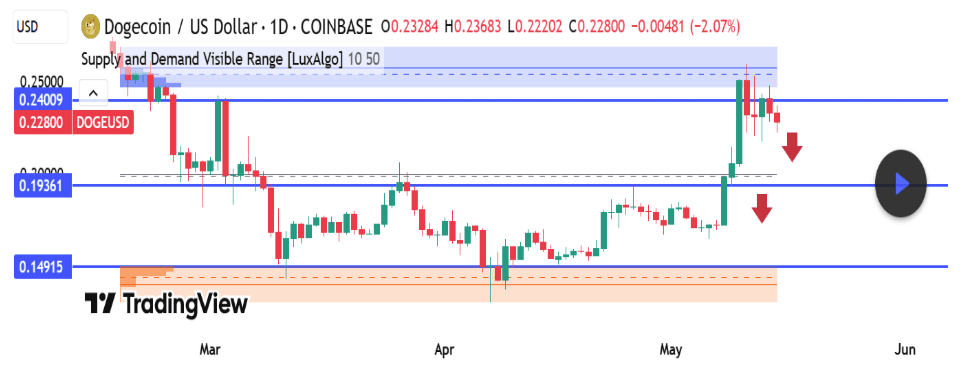

The retreat is a resulting effect of Dogecoin failing to break through a key supply zone between $0.24009 and $0.25000, which is an area that previously triggered a strong rejection in early March. Notably, a technical analysis of Dogecoin’s price action on the TradingView platform suggests that bears are slowly taking over.

Rejection At $0.24 To $0.25 Zone Causes Bearish Engulfing Pattern

Dogecoin recently faced a quick rejection at the $0.24009 to $0.25000 supply zone, which has caused a bearish outlook to start creeping in. This rejection is highlighted by an area that the LuxAlgo’s Supply and Demand indicator identified as a significant liquidity cluster.

Notably, the ensuing price action on the daily candlestick timeframe chart after the rejection has led to the creation of a bearish engulfing pattern. Price action in this region formed a series of bearish candles, which is a technical formation that shows sellers are regaining control after the bullish push. Furthermore, this is the second rejection from this level, following a similar failed breakout attempt in March. The double rejection reinforces the strength of the supply zone and a lack of buyer follow-through above $0.24.

Aside from the bearish engulfing pattern, the rejection is also followed by a clear increase in trading volume, which adds to the bearish outlook. It also supports the notion that Dogecoin may be entering a corrective phase in the short term.

Support Levels To Watch: $0.19 And $0.14

Now that a resistance level has been identified around $0.25, the Dogecoin path has a few paths to follow. The overall outlook is starting to tilt bearish, at least in the short term. With this in mind, the analyst highlighted two key support levels to keep an eye on.

The first support level is $0.19361. This price level served as resistance in April but flipped to support during the breakout earlier this month. A breakdown below $0.19361 would represent a significant technical failure and open the door for a deeper correction.

The first support level is $0.19361. This price level served as resistance in April but flipped to support during the breakout earlier this month. A breakdown below $0.19361 would represent a significant technical failure and open the door for a deeper correction.

Below that, the next central zone of support interest is $0.14915. This is a high-confluence demand zone where Dogecoin rebounded twice in March. This level also aligns with LuxAlgo’s supply and demand, which shows a high liquidity cluster around $0.15. If Dogecoin does reach here again, there is a high possibility of institutional interest and a bounce.

At the time of writing, Dogecoin is trading at $0.2171, down by 3.7% in the past 24 hours.

Featured image from Unsplash, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.