The dollar fell to a three-year low yesterday as investors dumped US assets in a ‘sell America’ trade.

US government bonds also came under pressure as the brief respite provided by Donald Trump’s 90-day pause on tariffs earlier this week proved short-lived.

Francesco Pesole, FX strategist at ING Bank, said: ‘A mad week for markets is ending with heavy losses for the dollar. The question of a potential dollar confidence crisis has been answered – we are experiencing one in full force.

‘The collapse is working as a barometer of ‘sell America’ at the moment.’

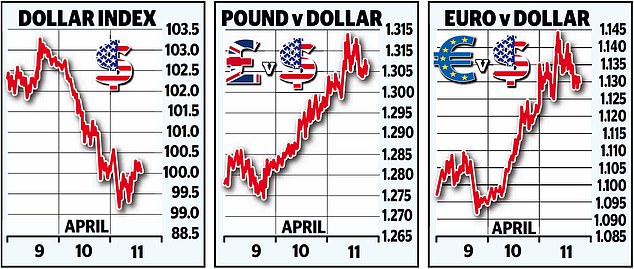

An index of the dollar against a basket of major currencies fell to 99 – the lowest level since April 2022 as fears mounted of a US recession.

Japan’s yen and the Swiss franc were among the beneficiaries as well as the euro, which spiked close to $1.15, its highest since February 2022. The pound topped $1.31, while gold hit a new record – above $3,245 an ounce.

Looking ahead: The brief respite provided by Donald Trump’s 90-day pause on tariffs proved short-lived

US ten-year borrowing costs were on course for their biggest weekly spike since 1981 as government bonds resumed their sell-off.

Bond yields, which rise as bond prices fall, climbed to 4.59 per cent – likely to be a major worry for the White House.

Trump is widely believed to have caved in on tariffs because of the bond sell-off earlier this week. But the resumption of the selling pressure – and the dollar’s slump – suggested the reversal has failed to placate markets.

There were knock-on consequences for Britain, with Government borrowing costs also rising. Yields on 30-year gilts saw their steepest rise this week since Liz Truss’s mini-Budget in 2022.

Deutsche Bank’s head of FX research, George Saravelos, said the damage to the dollar has been done: ‘The market is reassessing the structural attractiveness of the dollar as the world’s global reserve currency and is undergoing a process of rapid de-dollarisation.

‘Nowhere is this more evident than the continued and combined collapse in the currency and US bond market.’

Stock markets were largely calmer at the end of a wild week. The FTSE 100 ended 50.93 points, or 0.6 per cent, higher at 7964.18, while Germany’s Dax fell 0.9 per cent and France’s Cac 40 lost 0.3 per cent – modest falls after the carnage of recent days.

US stocks rose, with New York’s Dow Jones up 1.4 per cent, the S&P 500 climbing 1.7 per cent and the Nasdaq adding 1.8 per cent.

JP Morgan boss Jamie Dimon, the world’s most powerful banker, said the economy ‘is facing considerable turbulence’ and that ‘people are being cautious and pulling back on deals’. The bank put a US recession at 50/50.

Larry Fink, boss of asset manager Blackrock, said: ‘Uncertainty and anxiety are dominating every client conversation. I think we’re very close to, if not in, a recession now.’

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.