SSE, one of the largest renewable energy and network operators in the UK, has pushed up its full-year earnings forecast after a surge in gas and electricity prices.

The FTSE 100-listed power generator on Friday said it expected adjusted earnings of more than 150p a share for its financial year to the end of March, up from its earlier outlook of “at least” 120p.

The company, which owns onshore and offshore wind farms, hydroelectric power assets and power stations in the UK and Ireland as well as network infrastructure, said the upgrade reflected “the strength of the group’s diverse business mix” as well as “increased certainty from strong operational performance”.

The biggest driver of the earnings upgrade was the performance of the group’s gas assets, which include both power plants and storage facilities. The company owns about 40 per cent of the UK’s onshore gas storage, mostly held in underground caverns in Yorkshire.

Output from renewables such as onshore and offshore wind farms declined slightly as a result of calm weather conditions over the winter.

Power companies are benefiting from high energy prices caused by the Russia-Ukraine war. In November SSE posted a fourfold increase in profits in the six months to September, buoyed by the volatility in gas and electricity prices that has stoked a cost of living crisis. National Grid and British Gas-owner Centrica also raised their annual earnings expectations.

Shares in SSE rose 2 per cent on Friday following a 7.4 per cent increase over the past year.

Energy producers have been hit by a windfall tax on carbon generators, which came into force in January and charges a levy on certain low-carbon electricity generators’ sales above £75 per megawatt-hour.

Alistair Phillips-Davies, SSE’s chief executive, had warned that the tax could harm investment in the UK.

But the company said on Friday it remained on course to deliver record investment of more than £2.5bn this year “with clear visibility for further investment opportunities that support the transition to net zero”.

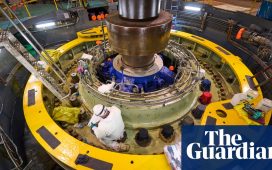

SSE is extending its renewables portfolio overseas as well as looking at expanding into hydrogen, carbon capture, solar and batteries. It is also extending its hydroelectric power assets and developing the world’s largest offshore wind farm at Dogger Bank off the coast of Yorkshire.

The company intends to recommend a full-year dividend of 85.7p a share but this would be cut next year to 60p to support its investment programme, SSE said.