Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

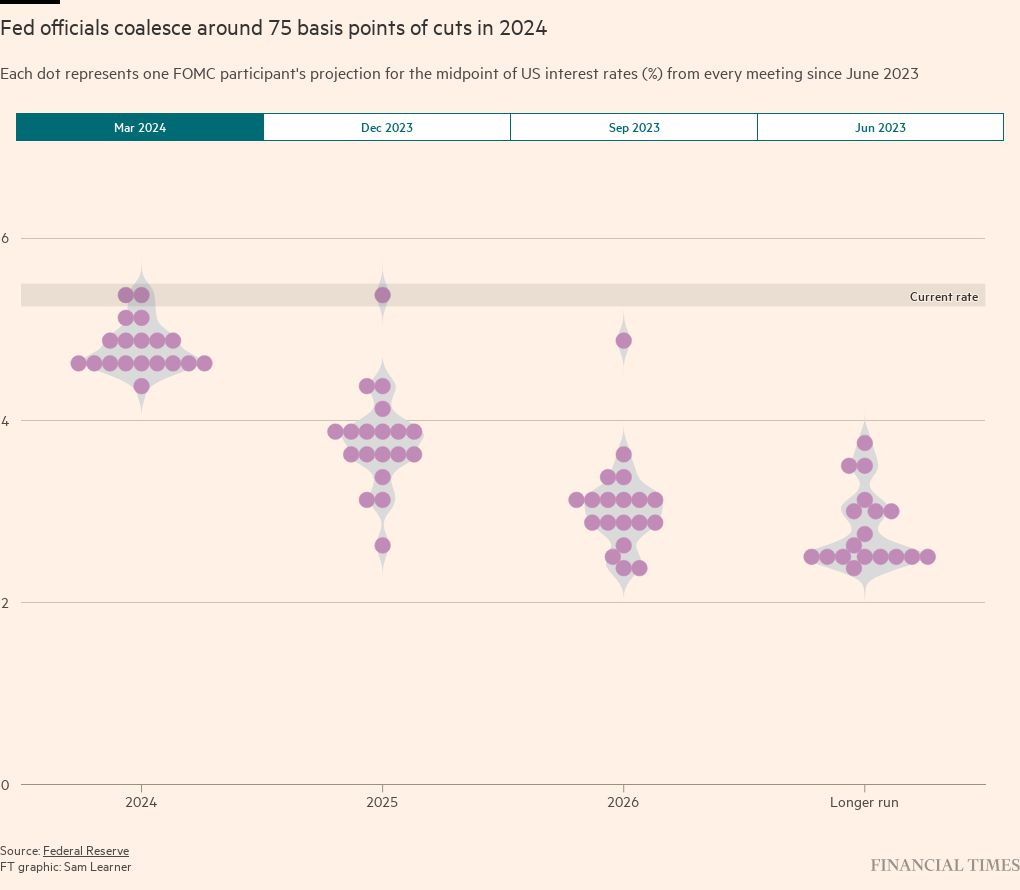

Federal Reserve officials have indicated they still expect to cut interest rates by three-quarters of a percentage point this year, sending US equity markets to record highs.

The market reaction on Wednesday came after the Federal Open Market Committee voted unanimously to leave rates unchanged at a 23-year high of 5.25 per cent to 5.5 per cent.

The central bank also sharply raised its forecast for US economic growth this year, while saying inflation would be slightly higher than expected.

The latest statement leaves the Fed on course to begin cutting rates as early as the summer, calling time on a mission to quell inflation that jumped as the US economy emerged from the Covid-19 pandemic.

It also means borrowing costs and mortgage rates that soared in recent months could begin falling just ahead of the presidential election in November.

“The economy is performing well,” said Fed chair Jay Powell in the news conference after the FOMC announcement. US gross domestic product would expand by 2.1 per cent this year, officials predicted, compared with their previous forecast of 1.4 per cent.

But with projections for core inflation of 2.6 per cent this year, slightly higher than expected, Powell signalled the path to a soft landing may yet be complicated.

Inflation was still on a “sometimes a bumpy road towards 2 per cent”, he said, referring to the Fed’s official target. “That’s why we are approaching this question carefully.”

The concerns about inflation were reflected in the Fed’s so-called dot plot. Although it showed officials believe rates would end 2024 at 4.5 per cent to 4.75 per cent — equivalent to three quarter-point cuts — far fewer expected the central bank to risk even deeper cuts.

The Fed’s policy statement was little changed from its vote in January, though a reference to a slowdown in the labour market was removed. “Job gains have remained strong, and the unemployment rate has remained low,” the FOMC said.

The market moves came after the Fed kept three quarter-point cuts on the table for 2024, scotching warnings from some economists that recent signs of higher inflation could spark a shift towards just two cuts.

The blue-chip S&P 500 closed up 0.9 per cent, at a new record, continuing a rally that has pushed the index 27 per cent higher since October. The Nasdaq Composite gained 1.3 per cent.

The two-year Treasury yield, which moves with interest rate expectations, fell 0.02 percentage points to a one-week low of 4.58 per cent. Asian stock markets followed the US higher, with Hong Kong’s benchmark Hang Seng index up 1.9 per cent and the Kospi 200 in Seoul up 2.9 per cent. The Stoxx Europe 600 rose 0.9 per cent to a record high in early trade on Thursday. Gold also made a fresh high, at $2,222, in Asia trading.

“Today’s dot plot shows that even though the Fed is expecting faster near-term growth and slightly hotter inflation, there is no change to rate cuts,” said Gargi Chaudhuri, head of iShares investment strategy, Americas at BlackRock. “They still think they need to gradually ease rates back. I think that’s a really great outcome for markets — for equity markets and for bond markets. It’s a really good outcome for investors.”

As Powell spoke, investors in the futures market added to bets on a rate cut in June, putting the odds at about 85 per cent, versus 65 per cent on Tuesday.

Eswar Prasad, professor of economics at Cornell University, said: “The Fed’s conservative approach is being vindicated by incoming data and by financial market participants dutifully falling in line with the Fed’s projected path of interest rates.”

Prasad added: “With no compelling reason to cut interest rates and with the persistence of inflation above target leaving it little room to cut, the Fed’s passivity on interest rates seems entirely justified.”

Alongside its more bullish outlook for economic growth, the Fed said it expected headline and core consumer price expenditures inflation to hit 2.4 per cent and 2.6 per cent this year, respectively, while unemployment would edge up to 4 per cent from 3.9 per cent. In December, the FOMC forecast headline and core CPE inflation of 2.4 per cent for 2024, and expected unemployment to rise to 4.1 per cent.

Powell suggested it was too soon to know whether recent signs of stickier than expected inflation, especially in the services sector, would last.

“We’re going to let the data show. We don’t know if this is a bump in the road or something more,” the Fed chair said, adding that he did not think recent readings had “really changed the overall story” of price pressures easing to 2 per cent.

The Fed also said it would maintain for now the pace at which it is reducing its bond and mortgage-backed security holdings, a process known as quantitative tightening.

But Powell said the sense of the committee “is that it will be appropriate to slow the pace of run-off fairly soon”, though he added that “does not mean that our balance sheet will ultimately have shrunk by less than what it would otherwise”.

Matthew Raskin, US head of rates research at Deutsche Bank, said he thought the meeting had set an overall “dovish” tone, as the higher growth and inflation projections contrasted with officials’ expectations to cut as planned.

“The striking thing about the statement is how little change there was. It might be as little change in a statement as we’ve seen in a while,” he said.

Additional reporting by Peter Wells in New York