Stay informed with free updates

Simply sign up to the Equities myFT Digest — delivered directly to your inbox.

Signs of a possible thaw in trade tensions helped drive global markets higher on Friday after Beijing said it was “evaluating” recent overtures from Washington on starting trade talks.

China’s commerce ministry said the US had recently “conveyed messages to China through various channels, expressing a desire to engage in discussions”.

“China is currently evaluating this,” the ministry spokesperson said.

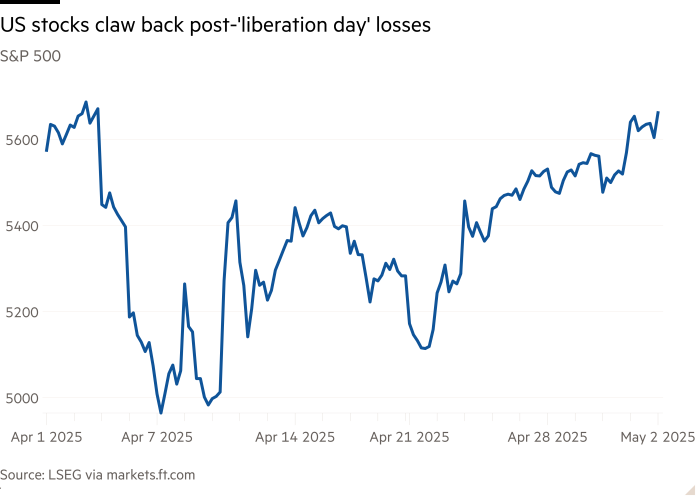

Global equities extended their gains further after stronger-than-expected US jobs figures on Friday morning, with the S&P 500 climbing 1.3 per cent by late morning in New York. The Wall Street benchmark has now erased all of its losses since Donald Trump’s “liberation day” tariff blitz on April 2 sent global markets into a tailspin.

“It is very clear that markets are past the peak tariff fear,” said Manish Kabra, head of US equity strategy at Société Générale.

“But have we really passed through the peak tariff impact? I think we are far, far away from that,” he added, suggesting that equities could fall again if Trump’s 90-day tariff pause, set to end in July, did not result in trade deals that significantly lower the levies.

Europe’s Stoxx 600 index closed 1.7 per cent higher on Friday, with Germany’s Dax index jumping 2.6 per cent. Asian markets had also rallied earlier, with Taiwan’s Taiex climbing 2.7 per cent and Hong Kong’s Hang Seng index up 1.7 per cent.

Kabra said that what happens next for stocks is “contingent on what happens in the trade talks.” His view was that equities could return to their April lows “if the US-China tariff discussions lead to more than a 50 per cent effective tariff between the US and China”.

Asian currencies rallied against the US dollar on the signs of easing trade tensions. China’s offshore renminbi climbed 0.7 per cent to Rmb7.23 while the Korean won strengthened 2.6 per cent to 1,406 to the dollar. The Taiwanese dollar led gains as it surged 5 per cent.

“[Asia ex-Japan] currencies are having a field day,” said Fiona Lim, a senior FX strategist at Maybank. “An end to this trade war . . . would provide a more benign environment for growth and investment in the region.”

Friday’s statement from China’s commerce ministry said the US must show “sincerity” for any talks to take place, which included “being prepared” to cancel its unilateral tariffs and taking other unspecified steps.

It marks a slight softening of China’s stance from last week, when Beijing said Washington would need to drop its steep levies on China for talks to begin. The potential opening for talks was first signalled by a social media account tied to state broadcaster CCTV on Thursday.

Beijing said its position had not changed. “China emphasises that in any possible dialogue or negotiation, if the US fails to correct its erroneous unilateral tariffs, it would indicate a complete lack of sincerity and would further erode mutual trust,” the spokesperson said.

“If it is talks, the door is wide open,” the ministry said. “If it is a fight, we’ll see it through to the end.”

The remarks from Beijing came as the US and Japan agreed to aim to have a trade deal ready by June.

Wall Street earnings also helped buoy sentiment in Taiwan and South Korea, home to the chip manufacturers essential for the continuing build-out of artificial intelligence servers.

Shares of Taiwan Semiconductor Manufacturing Co rose 4.6 per cent while SK Hynix climbed 4.8 per cent.