- US and China intend to cut their tariffs on each other by 115% for 90 days

Stock markets enjoyed a bumper performance after the US and China agreed to slash tariffs.

US Treasury Secretary Scott Bessent announced both countries would reduce their reciprocal tariffs on each other by 115 per cent for 90 days following discussions in Geneva, Switzerland.

This means Chinese imports to the US will be subject to a 30 per cent tariff, while the equivalent duty on US products entering China will be 10 per cent.

The FTSE 100 Index rose 0.69 per cent to 8,613 points by the late afternoon, while the mid-cap FTSE 250 was 0.83 per cent higher at 20,674.

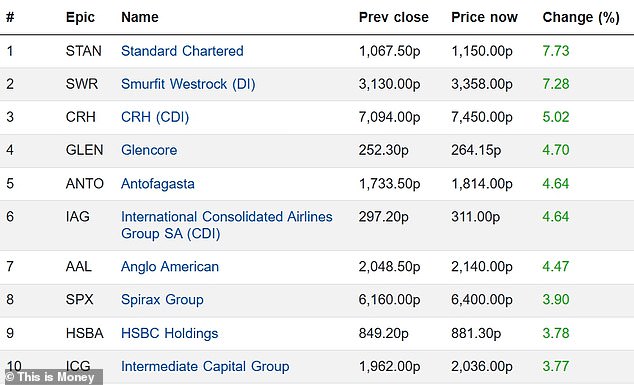

Asia-focused bank Standard Chartered was the fastest-expanding blue-chip firm, jumping 7.9 per cent to £11.52, followed by packaging group Smurfit Westrock, which increased 7.9 per cent to £33.78.

Also among the top five risers were building materials supplier CRH Holdings and commodities producers Glencore and Antofagasta, which rose by 4.7 per cent and 4.6 per cent, respectively.

Deal: US Treasury Secretary Scott Bessent announced that the US and China would reduce their reciprocal tariffs on each other by 115 per cent for 90 days

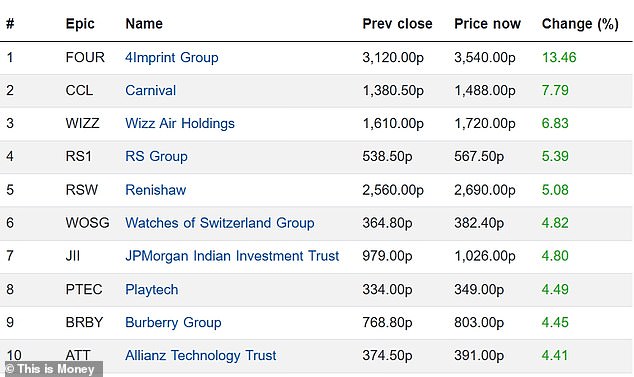

In the FTSE 250, promotional products seller 4imprint Group topped the charts, climbing by 13.5 per cent to £35.40.

Other strong performers included low-cost airline Wizz Air, cruise operator Carnival Corporation, electrical products distributor RS Group, and engineering company Renishaw.

France’s CAC 40 increased by 0.8 per cent to 7,805.1 points, while on Wall Street, the Dow Jones Industrial Average surged by over 1,000 points, or 2.5 per cent; the S&P 500 went up 2.7 per cent, and the Nasdaq Composite soared by 3.5 per cent.

Oil prices also experienced an uplift, with Brent crude rising by about 3 per cent to $66 per barrel, but gold prices fell 2.1 per cent to £2,458 per ounce.

Blue-chip: Standard Chartered was the top FTSE 100 riser

Mid-cap: 4Imprint was the biggest riser on the FTSE 250 Index

Announcing the latest agreement, Bessent told a press conference: ‘We concluded that we have a shared interest and we both have an interest in balanced trade. The US will continue moving towards that.’

He added: ‘The consensus from both delegations this weekend is neither side wants a decoupling.

‘What had occurred with these very high tariffs was the equivalent of an embargo, and neither side wants that.’

President Donald Trump started reimposing tariffs soon after returning to office in January as part of a goal to boost domestic manufacturing and reduce the US’s massive trade deficit.

Alongside a 10 per cent baseline tariff, Trump has implemented a 25 per cent tax on imported steel and aluminium goods and closed the ‘de minimis’ rule that exempted packages from China worth under $800 from duties and customs procedures.

He also briefly introduced reciprocal tariffs on dozens of countries before suspending them just hours later for 90 days.

The tariffs have led to considerable market turmoil, reduced trade flows between the US and China, and incited fears of a global recession happening this year.

Lale Akoner, global market analyst at eToro, remarked: ‘The US-China tariff truce is a tactical pause, not a final deal but for markets, but it’s a meaningful de-escalation.’

However, he warned: ‘With both sides keeping legacy tariffs in place and core disagreements unresolved, the road to a durable accord remains long.

‘This time could be different, but without a clear framework or binding terms, the risk of déjà vu lingers.’

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.