Wind and solar farms are wasting energy at rising rates by stopping production because there is not enough capacity to transport or store the electricity when demand is not high enough to use it straight away.

Almost one-tenth of Britain’s planned wind output was stopped from being produced last year and almost 30 per cent of Northern Ireland’s, according to analysis shared with the Financial Times by Aurora Energy Research.

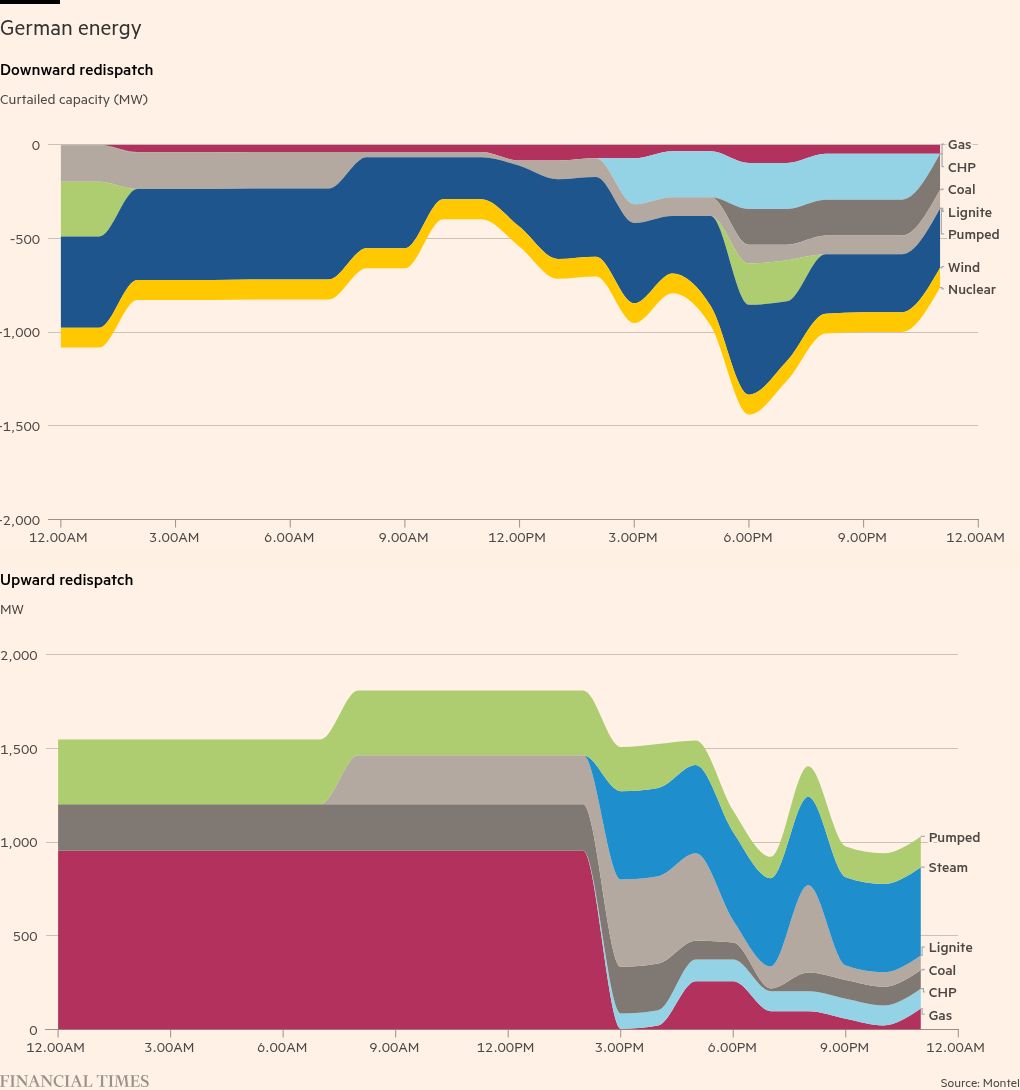

About 5 per cent of Germany’s renewables output was also curtailed the previous year and 2.5 per cent of France’s solar output restricted during the summer, a separate report from energy data group Montel found.

The waste is the result of the mismatch between the rapid rollout of weather-dependent wind and solar farms and the slower installation of cables to move electricity around, as well as the shortage of electricity storage through batteries and larger methods such as hydropower.

This is reflected in increasingly volatile short-term electricity prices, with intraday prices roiling between negatives and extreme highs in some markets in the past year.

There were a record 4,838 hours of sub-zero prices across all zones in Europe during 2024, and 176 hours in Great Britain, according to figures from trade group Eurelectric and Modo Energy, respectively.

Prices have turned negative during particularly windy or sunny periods, as generators in effect pay consumers or owners of storage systems to take electricity off their hands.

“The system is becoming short of reliable or flexible capacity — and this is something we need to address,” says Kristian Ruby, secretary-general of Eurelectric.

While the wind and the sun are free, and some level of wastage is to be expected, volatile prices and curtailment can be costly for developers and consumers, as well as a missed opportunity to save electricity for times of scarcity.

The dynamic illustrates some of the complexities ahead as countries attempt to shift away from fossil fuels and towards renewable energy.

In China, where the solar panel rollout is the most rapid in the world, curtailment rates have also become a growing feature, even as the country embarks on unparalleled grid investment of more than $800bn by 2030.

An average of more than 3 per cent of China’s planned wind output and 3.2 per cent of solar was curtailed in 2024, compared to 2.7 per cent and 2 per cent, respectively, in 2023, S&P Global Commodity Insights data shows.

Even at these levels, the wasted wind and solar generation amounted to 58.7TWh — enough to power 24mn households.

Both Europe and Britain have made rapid progress installing wind and solar panels over the past few years, with renewables sources generating more electricity than fossil fuels in 2024 for the first time.

But the surge of these intermittent sources of energy also brings greater difficulty in matching electricity supply and demand on a second-by-second basis to maintain system stability, while it is not practically or commercially easy to store electricity at large scale.

Many countries have limited capacity on cables running from wind and solar farms to areas of high demand such as city centres or industrial sites.

Generators sometimes switch off during those periods rather than lose money. But national electricity system operators can also step in and offer payments to generators to switch off to avoid overwhelming electricity grids in certain areas.

Depending on the circumstances, grid operators may simultaneously have to pay another power plant, typically gas-fired, in another area, to increase its output to make up for the curtailed generation.

The UK’s National Energy System Operator said these and other so-called balancing actions cost Britain’s electricity bill payers about £4 per month in the 2023-24 year, and it expected these costs to rise.

The vast majority of the wind power squandered in Britain was in Scotland, according to Chris Matson, analyst at LCP Delta.

It generates most of Britain’s onshore wind energy, but there is limited capacity on cables to take the electricity south to areas of demand. Maintenance on cable lines also contributed to wastage rates last year.

In Northern Ireland, Germany and Spain, curtailment is caused by a similar lack of capacity to take electricity from wind farms clustered in the north to areas of higher electricity demand further south.

“The key point is where the assets are compared to where the demand is,” says Rebecca McManus, analyst at Aurora Energy Research.

A surge of investment is going into infrastructure and technologies to help address curtailment rates and negative electricity prices, including cables, batteries, hydropower and “green” hydrogen as an energy store.

Investors poured a record $54bn into energy storage and $390 billion into electricity grids last year, compared with $728bn in renewable energy, according to a report published last month by BloombergNEF.

Across the EU bloc countries, about $81.3bn was invested in power grids and $10.4bn in energy storage, it estimated.

New cables are being laid between Scotland and England, as well as cross-border cables between Britain and European countries.

Aurora Energy Research estimates Europe’s battery storage capacity will increase around fivefold, to more than 50 gigawatts, in the next five years.

However, Eurelectric’s Ruby said more attention needed to be paid to getting the right mix of storage able to discharge over both short and long periods, as well as back-up generation capacity.

In Britain, the government is considering splitting the national electricity market into several geographical areas, with different prices determined by supply and demand in each zone.

Supporters say this should make the power system more efficient by encouraging people to use cheaper green electricity when nearby wind turbines are spinning rapidly.

Consumers and industry are also being encouraged to be more flexible about when they use electricity, for example by charging electric cars at times when energy use is not at its peak.

Experts say some level of curtailment may be cost-effective. Switching off assets at times of overproduction can remain a way to handle variable green energy output and reduce investment in other infrastructure, the International Energy Agency has said.

“There is a trade off,” said Marc Hedin, head of UK and Ireland at Aurora Energy Research. “You can oversize your grid to make sure you carry every single kilowatt-hour that is produced.

“Or, because wind has almost zero [marginal] cost, you could argue losing a bit is not the end of the world as long as you get enough down the line.”

But the problem of wasted of green energy is likely to continue to vex the operators of electricity systems for at least the rest of the decade, before enough storage and grid support is in place.

Hedin said that “in virtually any scenario”, the amount of curtailed energy in Britain would not decrease between now and 2030.

Jean-Paul Harreman at Montel added: “It will get worse before it gets better.”

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here