Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Food apps are governed by the law of the jungle: eat or be eaten. Deliveroo, despite a hearty dominance in the UK, was always going to be fodder. Its stock has been ravaged, making for a poor acquisition currency, and it has already been bullied out of half a dozen markets.

DoorDash, its US-listed putative owner, has the hallmarks of a survivor. With a market capitalisation of $79bn it is 23 times the size of its UK-listed prey, has form in nurturing acquisitions such as Finland’s Wolt, acquired in 2022, and boasts a 50-plus per cent share of the US takeaway market.

There is nothing to quibble about price-wise. An indicative offer of £2.7bn, or 180p a share, represents a 40 per cent premium to the three-month average. That implies a multiple of around 15 times this year’s consensus ebitda, ahead of the last deal in the sector — Prosus’s €4.1bn acquisition of UK-listed Just Eat Takeaway in February.

A counterbid is not impossible but unlikely. Amazon, with its 14 per cent stake in Deliveroo and tie-up for premium members of both outfits, has already drawn the attention of the UK’s competition watchdog. Prosus and Uber would incur similar scrutiny. Meituan is taking baby steps outside its home market of China.

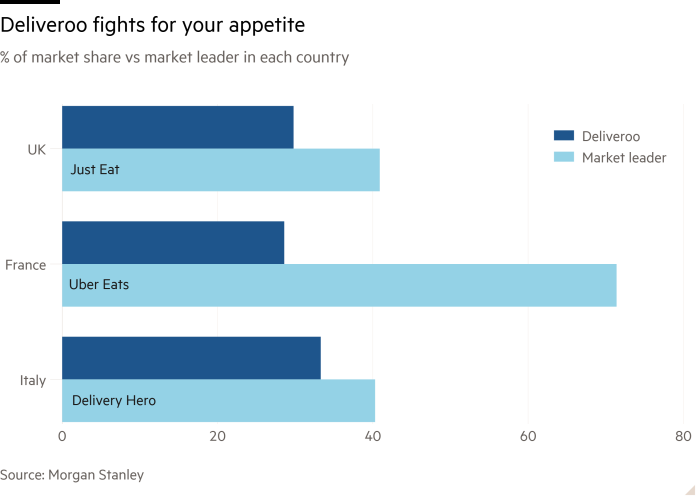

Much more likely is further consolidation. This is a market for deep-pocketed duopolies, not for those ranked third or fourth. Growth is thus about empire building: collecting top slots in as many jurisdictions as possible.

There are some financial incentives to ingest rivals. Tech spend can be leveraged across different regions. Algorithms optimising delivery routes or discount offers can be rolled out and updated globally, albeit savings here don’t begin to match the synergies gleaned from closing factories or pruning workforces.

Also tempting are the tax assets accumulated through years of red ink. Deliveroo, which only turned profitable on an annual basis last year, has £1.4bn worth of tax losses on its balance sheet. The extent to which these are transferable is not clear. But a “significant portion” arises in the UK, where there is no use-by date — a useful cache if a buyer is able to cash them in against future UK taxable profits.

Duopolies typically benefit shareholders more than customers, but diners need not be spooked back into the kitchen by this one. Dominance in food delivery is a game fought with discounts for consumers and incentives for merchants, making for a rather lean kind of victory.