CNBC’s Jim Cramer on Thursday highlighted two stocks in the retail space that he thinks investors have an opportunity to buy on the dip — Gap and Ralph Lauren — even as Wall Street worries broadly about tariffs and the strength of the consumer.

“As long as you don’t think the entire economy’s about to fall off a cliff, and there’s still some of us who feel that way, then some of these high-quality retailers are looking darned cheap at these levels,” he said. “Ralph Lauren and the Gap are my faves right now.”

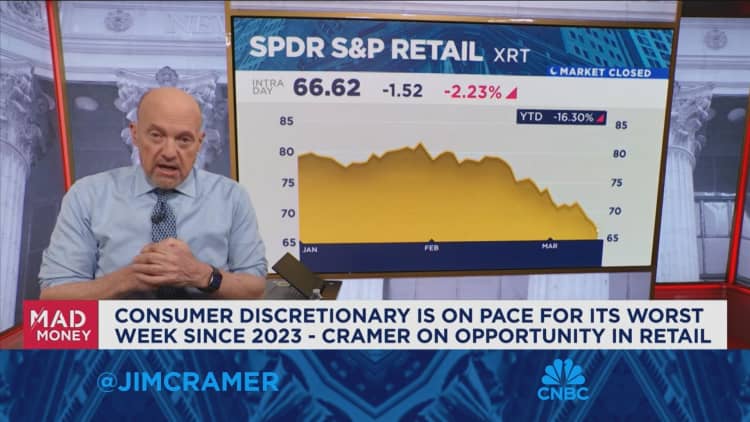

Cramer acknowledged that the retail sector has been in the “blast radius” of the swiftly escalating trade war, which began when President Donald Trump issued steep tariff hikes on some of the U.S.’s allies and major trading partners. Consumers are worried tariffs will drive up costs, he said, and are less willing to shop. But Cramer suggested the “tariff reign of terror is temporary,” and that eventually the U.S. will get used to the policies or there will be some sort of resolution, and some retail stocks will bounce back.

Beyond the strength of Ralph Lauren’s recent quarter, Cramer said he thinks the stock is more likely to make a comeback than some of the others in the industry. The brand has managed to maintain cultural relevance, he said, and its target customer is wealthier than average, so there’s a decent chance it might be one of the first to rebound, Cramer added.

Cramer was also impressed by Gap’s recent quarter, and the success relatively-new CEO Richard Dickson has had growing its four brands — Old Navy, Banana Republic, Athleta and its namesake. He also pointed out that Dickson claimed the apparel company’s supply chain is diverse, with 10% of products coming from China and less than 1% coming from Canada and Mexico combined, so it may be somewhat protected from tariff-induced business woes. Dickson said he’s confident about the future because Gap has managed to gain market share against the backdrop of industry-wide decline, and Cramer largely agreed, even though the company may still face some near-term issues.

“If you buy them and the president basically assures you that the forecast is pain, there’s not much you can do short term,” he said. “But longer term, you will do fine – I just can’t predict when longer term starts.”

Ralph Lauren and Gap did not immediately respond to requests for comment.