Stay informed with free updates

Simply sign up to the UK house prices myFT Digest — delivered directly to your inbox.

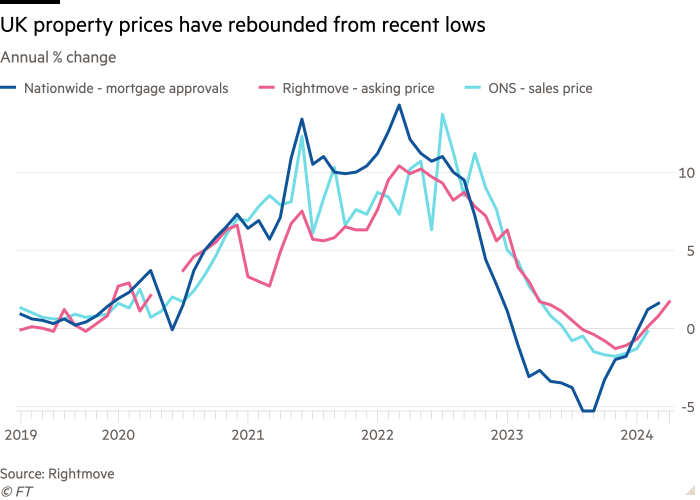

Asking prices rose to a near-record level in April, driven by larger properties, according to data that points to a continuing recovery in the UK housing market despite recent volatility in mortgage rates.

The average asking price of properties coming to the market rose to £372,324 in the four weeks to mid-April, up slightly more than 1 per cent on the previous month and just £570 short of the level in May last year, which was the highest on record since property portal Rightmove started collecting the data in 2001.

The main driver was the increase in the pricing of four-bedroom, detached properties and larger houses, which recorded a rise of 2.7 per cent month on month.

“The top-of-the-ladder sector continues to drive pricing activity at the start of the year, with movers in this sector typically less sensitive to higher mortgage rates, and more equity rich, contributing to their ability to move,” said Tim Bannister, Rightmove’s director of property science innovation.

The data comes against a backdrop of recent volatility in the mortgage market. Home loan rates peaked in the summer of 2023 before declining sharply at the end of last year.

Since then, disappointing inflation data has led the markets to reassess the timing and extent of interest rate cuts by the Bank of England this year, resulting in some mortgage rates increasing again since February.

Official data out last week showed inflation fell less than expected in March to 3.2 per cent, albeit to the lowest level in two and a half years.

The average asking prices for properties of up to two bedrooms, which Rightmove classifies as being for first-time buyers, was almost flat month on month at 0.3 per cent. The bracket for three- and non-detached, four-bedroom properties recorded a 0.9 per cent rise in asking price.

Year on year, the average asking price rose 1.7 per cent across all property types, the highest annual rate in 12 months, according to the portal.

Rightmove said the number of new properties coming on the market was up 12 per cent annually, with a similar increase for sales agreed. Much of this activity was also at the top end of the housing ladder sector.

Kevin Shaw, national sales managing director at the property services company Leaders Romans Group, said: “2024 is off to a good start with more properties coming on and more sales happening.” But he warned that price sensitivity was still an issue and said sellers needed to be realistic and “manage their expectations”.

The Rightmove house price index is compiled from properties coming on to the market through more than 13,000 estate agency branches listed on the portal.

It tracks prices earlier in the sale process than other indices. The Nationwide Index, for example, is based on mortgages approved in the month, while the official house price index tracks prices of completed transactions.