- Aim is to bring two giants together so they can compete with international rivals

- BP’s problems mounted when it posted a slump in profits

- Aggressive New York investor Elliott builds up near 5% stake

Top investment bankers are looking to engineer a merger between BP and Shell to create one national champion, The Mail on Sunday understands.

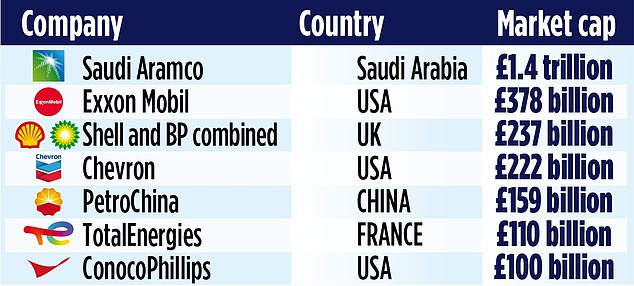

The aim is to bring the two oil giants together so they can compete with international rivals such as France’s TotalEnergies and US giants ExxonMobil and Chevron.

BP’s problems mounted last week when it posted a slump in profits, while aggressive New York investor Elliott Investment Management confirmed it had built up a near 5 per cent stake.

BP’s chief executive Murray Auchincloss is now under huge pressure ahead of a crunch shareholder meeting on February 26.

He will be expected to lay out a credible strategy that can put the company back on track.

Some dissatisfied investors have told The Mail on Sunday that he is in the last chance saloon. Over the past year BP’s share price has fallen 2 per cent and its market capitalisation is now £74 billion.

Under pressure: BP’s chief executive Murray Auchincloss is expected to lay out a credible strategy that can put the company back on track

Shell by contrast has gone from strength to strength under Wael Sawan, who has cash to spend after slashing its debt pile.

Its shares have risen 9 per cent over the past 12 months, valuing the business at £164 billion. But valuation remains an issue for Shell too. Sawan has threatened to move the company’s primary listing to the US if it does not improve.

Bankers believe that a tie up between the two makes sense. This would create a behemoth with 180,000 employees. The two companies have similar exploration projects in Iraq and the Gulf of Mexico that could be merged, as well as high performing trading arms.

Creating one national champion would give the companies the scale needed to compete against rivals. Size matters, as the cost of capital needed to extract oil makes it a very expensive business.

Graham Ashby, at asset manager Schroders, which has stakes in both companies, said: ‘Look at the Saudis and the Americans, they have scale. It is the most important factor in the oil industry. Forget the war in Ukraine and Opec. They are side issues.

‘The cost of capital is so high that to extract oil without scale means it is impossible to make money.’

Shell’s bankers include Citigroup and Rothschild, while BP has Robey Warshaw and Morgan Stanley. One investment banker said: ‘Shell’s advisers and the rest of the City will be doing the sums. There is a deal to be done.’

The speculation comes as the Labour Party looks to water down the powers of the Competition and Markets Authority.

Former Amazon boss Doug Gurr has been installed as its chairman after Business Secretary Jonathan Reynolds last month ousted Marcus Bokkerink.

Hungry merger and acquisition bankers are also setting their sights on other industries, where they believe mergers could create national champions. The pharmaceutical, banking and telecoms sectors have all been tipped for a wave of consolidation.

Analysts say that BP may announce plans to offload assets including its US shale oil and gas division and its lubricants business Castrol, which it bought for £4 billion in 2000.

There is even some talk that its petrol forecourt business could be on the block.

Elliott, run by Paul Singer, wants the company to slash spending on renewables and sell a significant proportion of its green assets.

It could also push for chairman Helge Lund to quit.

Auchincloss took the top job after the shock departure of his predecessor, Bernard Looney, following undisclosed relationships with staff. The Canadian, who was BP’s finance chief until his promotion, promised investors he knew ‘exactly what we need to do to grow the value of BP’.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.