Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Homebuyers in the US go to one agent to find a property, and another to find a mortgage. Rocket Companies wants to do both. This week it struck an all-stock deal to buy Redfin, the real estate listing site, for an equity value of $1.75bn. Its end goal: to become a “housing super app”.

On paper, this makes sense. In its presentation to shareholders, Rocket represented the opportunity as a giant funnel. At the top are the 62mn monthly visitors to Redfin and Rocket’s websites. All these house-hunters could ultimately be referred to Rocket for a mortgage and other adjacent services.

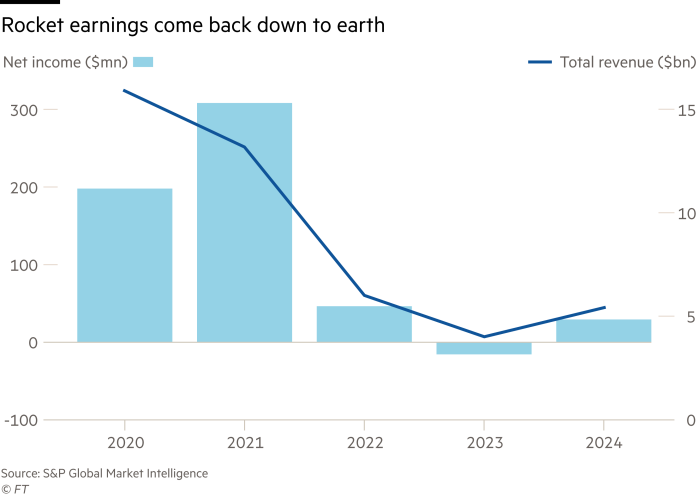

Finding new customers would be particularly useful given high interest rates have put the US housing market on ice. Rocket’s closed-loan origination volume last year came in at just a third of the level recorded in 2020 at the height of the pandemic mortgage boom.

But building a US super app is easier said than done. Rival online property listing company Zillow announced plans to create one back in 2022. It’s been slow going. At the time, it said the super app could help deliver $5bn of revenue and a 45 per cent adjusted ebitda margin by 2025. It managed to pull in figures that were about half of those levels last year.

Compared to China, where Tencent’s WeChat is used for everything from messaging and gaming to food delivery and paying the rent, US consumers are accustomed to using different apps for different functions; WhatsApp for messaging, Venmo for payments and Spotify for music.

This means companies looking to create a super app in the US would need to overcome entrenched consumer behaviours. People would also have to be comfortable with having all their personal data tracked by one app. This is no small feat at a time when trust in Big Tech has deteriorated significantly.

And, while lossmaking Redfin is small compared to Rocket, the mortgage lender is paying a steep price: more than twice Redfin’s market capitalisation before the deal was announced. Redfin’s shareholders would be capturing almost all the $1.1bn net present value of the cost savings Rocket thinks it could wring from a deal. And this target looks ambitious, too, amounting to 27 per cent of Redfin’s operating expenses.

Scepticism is reflected in the 12 per cent drop in Rocket’s share price since the deal was announced on Monday — admittedly in the context of choppy US markets. That will do little for those hoping for a rebound in US M&A.

Rocket’s shareholders, meanwhile, will be watching with concern. Creating a super app sounds great — but pulling off a fairly straightforward all-stock merger on reasonable terms might have been better.

pan.yuk@ft.com