Receive free Lex updates

We’ll send you a myFT Daily Digest email rounding up the latest Lex news every morning.

It took navigationally challenged Greek hero Odysseus 10 years to get from Troy to Ithaca, a distance of just 500 miles. Ithaca Energy is on a ramble of its own. Since its return to the London market last year, it has lost £800mn in market value.

On Wednesday, the UK approved a large North Sea oil project. This undercut ministers’ battered environmental credentials. It also restored some faith in Britain’s battered oil and gas sector. But for Ithaca, recovering its peak £2.5bn capitalisation remains a distant objective.

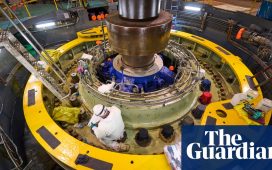

Rosebank will be one of the largest undeveloped oil projects in UK waters. As such, it is the bugbear of green campaigners who oppose the UK’s increasingly permissive stance towards fossil fuels.

First production is expected as early as 2026. A second phase should follow five years later, adding 55mn barrels. Majority partner Equinor of Norway is confident it can commercialise the field, despite its location 1,100 metres below rough seas to the west of Shetland.

Ithaca will pay 20 per cent of the $3.8bn required to unlock an initial 245mn barrels of light oil. It should have no problem financing its share of project costs. It generated $1.1bn of free cash flow last year. It has been using that to deleverage. Even after accounting for a $400mn dividend this year, it could still have wriggle room for further M&A, says Mark Wilson of Jefferies.

The shares rose more than 9 per cent on the day to 178.8p. That is still nearly a third below its 250p initial public offering price. Ithaca trades just at 1.6 times enterprise value/forward ebitda.

The UK’s previous adherence to green energy policies has taken a heavy toll on UK-focused oil and gas companies. Investors were caught off guard last year when the government added 10 percentage points to its unpopular energy profits levy.

The UK Labour party has vowed a tougher stance on new oil and gas drilling if it wins power in elections next year, as polls suggest it would. Rivals such as Harbour are looking to diversify abroad.

Having locked in Rosebank at home, Ithaca must set sail again in search of foreign opportunities.

Lex is the FT’s concise daily investment column. Expert writers in four global financial centres provide informed, timely opinions on capital trends and big businesses. Click to explore