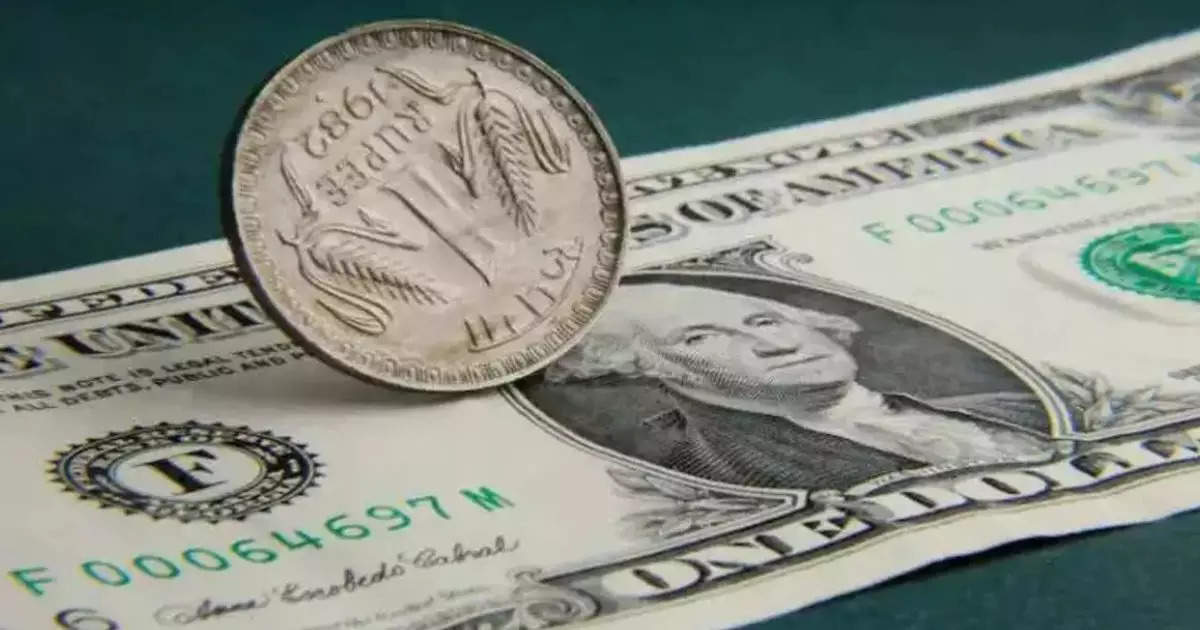

“RBI probably was present in the market throughout the day ensuring the rupee does not falter as rupee moved between 87.10 to 87.40 per dollar and closed at 87.20/$1,” said Anil Bhansali, head of treasury at Finrex Treasury Advisors.

Asian currencies also weakened on Thursday as the U.S. dollar gained, driven by uncertainty over the timing of tariffs.

Traders will be watching out for data scheduled to be released on Thursday and Friday to gauge the Federal Reserve’s decisions regarding potential rate cuts. On Thursday after market hours, the U.S. will release data on initial jobless claims, pending home sales, and preliminary third-quarter GDP growth. On Friday, the core PCE price index will be released.

Markets however do not expect a rate cut by the US Federal Reserve in its upcoming meeting on March 19. According to the CMEs FedWatch group, 97% expect the US Fed to hold its interest rates.