- S4 Capital reported its net revenue declined by 13.6% to £754.6m in 2024

S4 Capital’s revenues shrank again last year amid continued economic uncertainty and weaker spending from the ad group’s technology businesses.

Sir Martin Sorrell’s advertising agency, which he founded after his departure from WPP, reported its net revenue declined by 13.6 per cent to £754.6million in 2024 after falling by 2.1 per cent the previous year.

The London-based group said the result reflected the spending priorities of tech-focused clients, which are ‘investing significantly in capital expenditure to build Artificial Intelligence (AI) capacity’ at the expense of marketing.

Revenue was also hit by lower spending from one major tech services business in the Americas, high interest rates, and greater caution among clients across all regions.

While trading improved in the fourth quarter, subdued conditions in the second half and the medium-term outlook following the completion of its budget led to S4 Capital declaring £280.4million in net impairment charges.

As a result, its losses soared from £14.3million in 2023 to a whopping £306.9million last year.

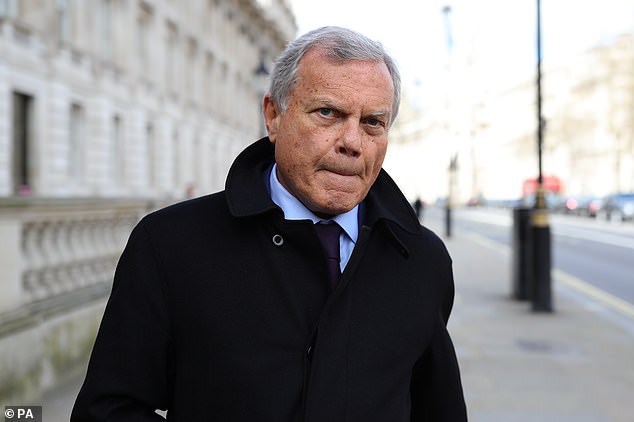

Warning: ‘The macroeconomic environment in 2025 will remain challenging given significant volatility and uncertainty in global economic policy,’ said Sir Martin Sorrell

S4 Capital expects continued cautionary behaviour from clients in the near term due to worries about tariffs and economic uncertainty.

Since President Donald Trump returned to office in January, his administration has imposed massive tariffs on China, Canada and Mexico, as well as a 25 per cent tax on steel and aluminium imports entering the US.

This has led to retaliatory measures by the Canadian and Mexican governments, as well as the European Union, which recently imposed what it called ‘countermeasures’ worth £22billion on US exports.

Sir Martin, who turned 80 last month, said: ‘The macroeconomic environment in 2025 will remain challenging given significant volatility and uncertainty in global economic policy, particularly tariffs.’

He pointed to the Ukraine war, cooling relations between the United States and China, and elevated tensions with Iran as geopolitical factors impacting client behaviour.

But he still expects S4 to generate new business, particularly in the second half of this year, and net revenue and operational earnings before nasties being ‘broadly similar’ to 2024 levels.

S4 Capital shares soared 11.95 per cent to 36.9p on Monday morning, although they have contracted by around three-quarters over the past five years.

Analysts at Peel Hunt, which maintained a hold rating on S4 shares with a target price of 40p, said the group ‘has made progress with cost control, and margins remained resilient despite the revenue decline’.

They added: ‘However, we believe a more supportive industry backdrop and stronger growth are needed for the shares to gain momentum.’

Following its founding in 2018, S4 Capital expanded rapidly through acquisitions of companies such as MediaMonks and Los Angeles-based MightyHive and winning large contracts from big names like Google, Meta, and Allianz.

However, this growth came to a shuddering halt in 2022 after it had to delay the publication of its annual results twice due to accounting issues.

Analysts said the speed of the firm’s expansion left its finance team struggling to cope. Sir Martin apologised for the ‘unacceptable and embarrassing’ delays.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.