It’s another mixed bag for Snap Inc. in its latest performance update, with the platform adding more users, though not in its most lucrative markets, while revenue also increased, though not at the levels expected.

Thus is the theme of Snap’s performance, a yin-yang of strengths that are also weaknesses, in virtually every element.

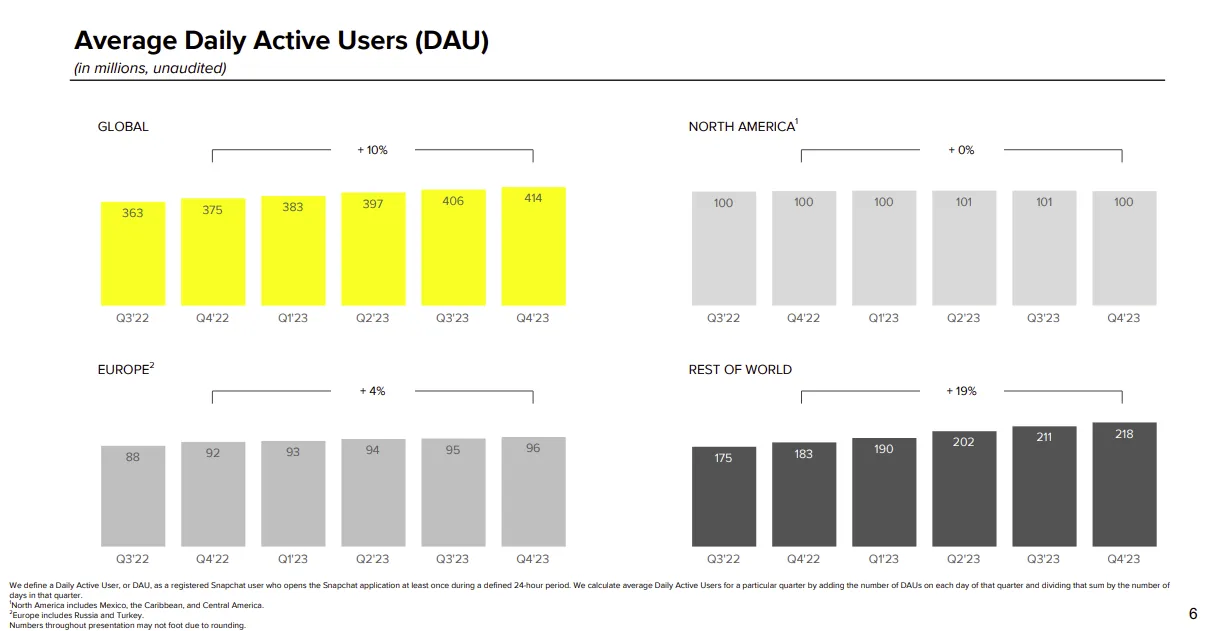

First off, on usage. Snapchat rose to 414 million daily active users in Q4, a 10% YoY increase.

Which is a positive, though as you can see, Snap actually lost a million users in North America, which is a significant note over the holiday period.

Almost all of the platform’s growth once again came in the “Rest of the World” segment, which has been the same story over the past year. Snapchat’s seen rising interest in India, which had been a focus of its development push, but it now says that it’s going to change its approach to hone in on “more mature” markets.

As per Snap:

“While we see significant long-term potential for community growth in Rest of World, we are shifting more of our focus toward community growth in our more mature geographies like North America and Europe. Over the past several years, we’ve driven significant growth in DAU by focusing on Android performance in large emerging markets, including India. We will continue to build on our momentum in the APAC region while increasing our investment in improving the product experience for our community in North America and Europe.”

Indeed, last week, Snap launched a new ad campaign in North America, in which it pitches itself as “the antidote to social media”.

Whether that will get more people using the app remains to be seen.

In terms of user engagement, Snap says that total time spent watching its TikTok-like Spotlight feed increased more than 175% year-over-year, while Spotlight average monthly active users increased more than 35% year-over-year.

Which is no surprise given the broader popularity of short-form video, though it is also worth noting that Snap has discontinued funding for its Snap Originals programming, likely as a result of more interest in cheaper, user-generated content.

Instead of Originals, Snap’s instead looking to work with popular creators on new initiatives, and it did see growth on that front, with public Stories posted by Snap Stars rising 125% year-over-year in the U.S. Snap’s also looking to help creators parlay their platform popularity into brand deals, as a means to establish a more sustainable process for creator revenue share.

AR also remains a key area of opportunity for the platform, with over 350,000 creators and developers now having built almost 3.5 million AR Lenses for the app. On average, 300 million Snapchatters engage with AR every day, and if Snap can convert that into expanded business offerings, that could still play a key role in its future.

Though it’s also taken a step back on that front, with Snap shutting down its third-party AR development platform ARES late last year as part of its cost-cutting measures. Which is the challenge of its broader business struggles, in that it needs revenue to fuel development, but it needs to reduce costs to rationalize the business.

Which brings us to its latest revenue results:

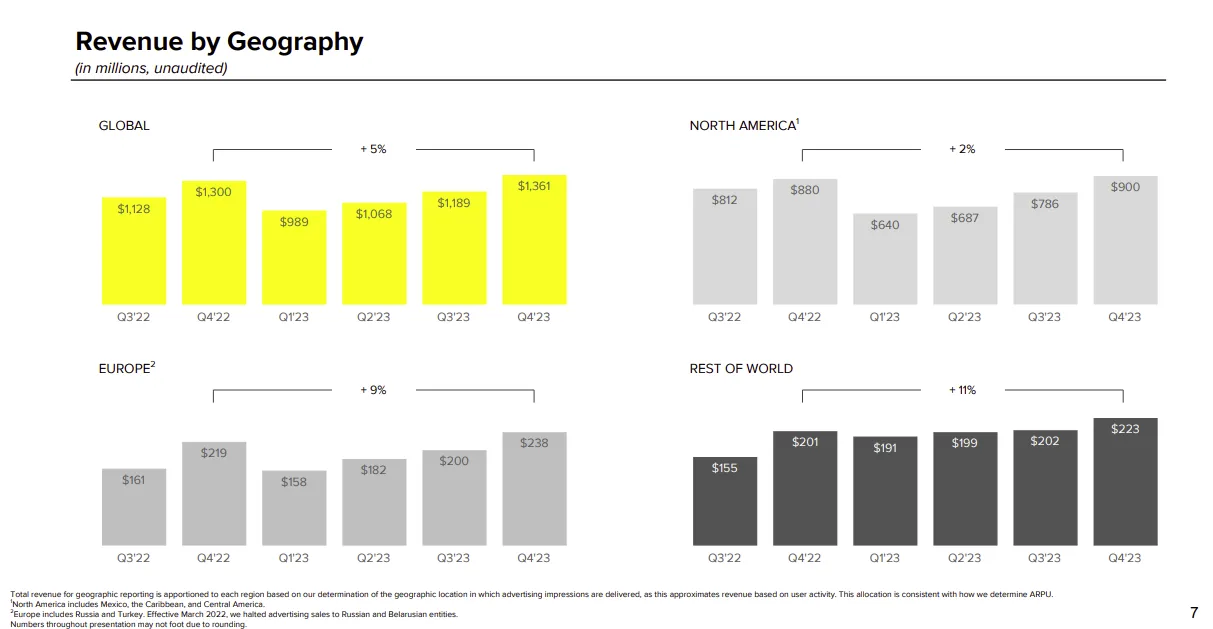

As you can see, Snap brought in $1.36b in revenue for the quarter, an increase of 5% year-over-year. Which is relatively good given the broader market conditions, but not as good as the market was expecting.

A big problem for Snap, as noted, is that while it is growing, it’s struggled to expand its audience in its key revenue markets, with usage in North America and EU remaining relatively flat. Which is a big concern when you look at these charts:

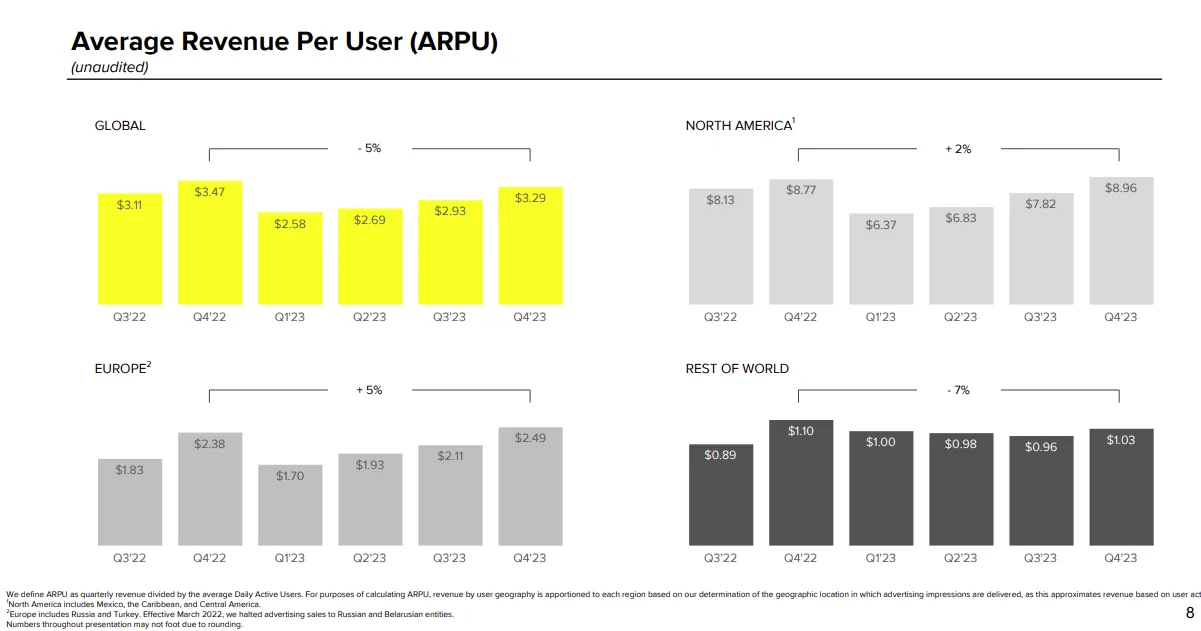

Snap’s average revenue per user is not only way lower in the “Rest of the World” category, where virtually all of its growth is coming from, but it’s also declined over the last year. So again, while it is expanding its audience, which should present future opportunities, its current market potential isn’t growing, which reflects poor capitalization on that growth.

That could suggest flaws in Snap’s evolving business plan. And as reported by CNBC, today’s report also marks six consecutive quarters of single-digit growth or decline at the app.

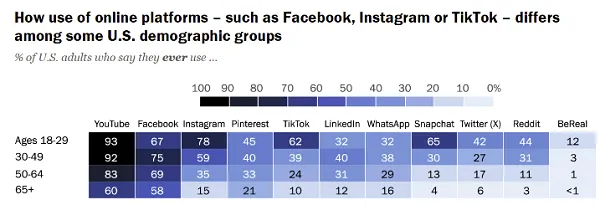

Snap does have potential, and at 414 million active users, and growing, there should be more value there. But another challenge for the app is that it’s still not ageing up with its audience, and not resonating beyond its core demographic.

As you can see in this chart, nobody over 30 is active on Snap, with the app seeing the second lowest combined overall usage among older audiences of the major social apps (only just beating out Reddit). Snap has been trying to improve on this, but thus far, it remains a niche audience platform. Which is also its key strength in many respects, and something that it has used in its ad partner pitch in the past. But it does also limit its business potential, as fewer brands are looking to reach this market.

And with its AR ambitions seemingly also taking a hit due to lay-offs and other cost-cutting measures, it does seem like Snap’s opportunities are limited, and will remain that way for some time.

At one stage, it looked like Snap would be the leader of the AR race, with its Spectacles glasses set for an AR upgrade in future. But now, Apple and Meta are shifting into gear with their AR offerings, and with far larger resource pools for respective development, it’s hard to see Snap getting back into this race.

Maybe it can. Spiegel has also said that its AR ambitions remain a key focus, despite its cost cutting, though Spiegel has also criticized the broader metaverse push from Meta, which it sees as the next stage of digital connectivity.

So again, there are many contradictions within Snap, and for every positive, there’s also a note of potential negative as well, maintaining its less-than-ideal market balance.

Is it still a good future bet? For users, Snap remains a key connector, and a critical tool for teen connection in particular. But for investors, it may be less valuable, at least till it can get its revenue back on a solid track.