Stay informed with free updates

Simply sign up to the Renewable energy myFT Digest — delivered directly to your inbox.

Supply chain constraints threaten the UK’s goals for renewable energy, a report commissioned by the government has warned.

Fierce global competition for the workers and equipment needed to build wind turbines, electricity cables and solar panels could hold back UK projects, said the report by consultancy Baringa.

“Achieving the renewables deployment ambitions will be very challenging without significant co-ordination across industry and government to resolve supply chain constraints,” said the report’s co-author, Rob Gilbert, a partner at Baringa.

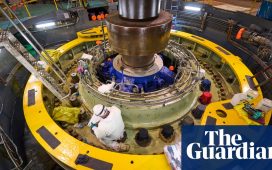

Ministers are aiming to triple the UK’s offshore wind capacity to 50 gigawatts by 2030 and quadruple solar capacity to 75GW by 2035.

However, Baringa’s report warns that these targets could be missed due to shortages of some products — in particular for offshore wind farms. These include turbine foundations and high-voltage electricity cables, and the ships needed to install them.

Suppliers have been reluctant to develop new factory capacity due to uncertainty around turbine sizes and the level of state support for wind farm developers.

According to the report, supply chain constraints for solar farms are “less severe”, in part due to increased manufacturing capacity in China. But it also highlights concerns about forced labour in Chinese supply chains.

Gilbert said the government had already taken steps to boost supply chains, such as increasing support for offshore wind developers. But he added there still needed to be a “holistic review” of skills, and said industry and government needed to work more closely together.

Baringa’s report comes as the offshore wind industry on Wednesday publishes its long-awaited industrial growth plan, setting out steps to boost the manufacturing of parts in the UK.

Offshore wind has been a success for the UK, which is second only to China in terms of installed capacity and that planned for the future. But most of the critical components are currently made outside the UK.

The industrial growth plan recommends making a priority of investment in crucial areas, including designing and manufacturing offshore wind blades and towers, foundations, and electrical systems.

Dan McGrail, chief executive of RenewableUK, the trade group that developed the plan with government representatives, said an investment of about £2.8bn in these areas could yield about £25bn in “gross value added” to the economy.

Tim Pick, the UK government’s former offshore wind champion, said supply chains were a “very significant opportunity for the UK” and could help replace jobs in areas where other industries have dwindled.

A spokesperson for the UK’s Department for Energy Security and Net Zero said the government was “confident in and committed to meeting our renewables ambitions, with strong plans for doing so”.