Rosyth dockyard lies just upstream of the three bridges – two road and one rail – that span the Firth of Forth. But on a September morning it is impossible to see the river through the thick early mist that blankets central Scotland.

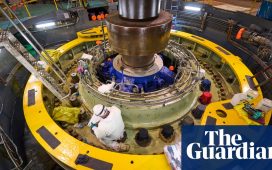

Here, on the northern bank of the Forth, the 2,500 workers at defence and aerospace company Babcock International are hard at work building the first two of five Type 31 frigates for the Royal Navy.

Thanks to a major investment by the company, the warships are being constructed inside a giant shed, so work on them can continue in all weathers. In the circumstances, it seems a wise move.

Babcock faces problems familiar to any UK manufacturer, not least how to find skilled workers. Its solutions include employing 200 production support operatives in training roles, an on-site branch of Fife College to help attract young recruits, and a thriving apprenticeship programme. Neil Bennett, director of shipbuilding, says: “It’s a struggle to get people across the UK with the skills to do the type of work we do here.”

Across the river, Edinburgh is humming. The festival may be over but it is hard to get a table in restaurants in the swankier parts of the city. As Scotland’s administrative capital, with the biggest concentration of financial services firms outside London, Edinburgh feels like a wealthy place. Scotland’s economy is slowly on the mend, despite last week’s confirmation that its only oil refinery, at Grangemouth on the south bank of the Forth, will close next year, putting hundreds of jobs at risk.

Ten years ago this week, Scotland voted by 55-45% to remain part of the UK, but independence is still a live issue. Despite the heavy losses suffered by the SNP at the recent Westminster election, polls suggest a second referendum would again be a close-run thing.

The economy remains central to the independence debate. In 2014, the “no” campaign won because it persuaded enough voters that going it alone would make them poorer.

A key issue was Scotland’s post-independence currency. The Scottish government’s official policy was that monetary union with the UK would continue, even though this had been ruled out by the then chancellor, George Osborne.

Craig Dalzell, of the left-of-centre Common Weal thinktank, says: “Which currency an independent Scotland would use was obviously the most prominent question that came out of the referendum debate. It was a proxy question. People were saying ‘can you assure me the economy will be OK?’ and were not reassured because they weren’t told which currency would be used.”

The SNP’s position is that it would continue using the pound for an unspecified period while making preparations for a new currency, much as some Latin American countries use the US dollar.

Kate Forbes, Scotland’s deputy first minister, says the currency is unlikely to be a decisive factor in any future referendum: “I can’t think of any other country that has secured its independence purely on the question of currency. So we look at other nations and see that there are successful independent small European countries without the comparable strengths and advantages Scotland has. If they can do it, so can we.”

But the SNP compromise of a Scottish currency in the fullness of time does not convince everyone. Former prime minister Gordon Brown, who opposes independence, says: “They [the SNP] want to keep using the pound for an unspecified period. The whole thing is chaotic.”

Dalzell, who is pro-independence, says there should be no delay in creating a Scottish currency after a yes vote. Without control of the macro-economic levers, he says, it will not be possible to make the transition to a viable independent state committed to rapid decarbonisation. He adds that the risk of the financial markets turning nasty is exaggerated: “As long as a country is not in junk-bond status, there is little correlation between its credit rating and the interest rate on its bonds.”

Forbes says the Scottish economy is in reasonable shape but would be doing better were it not for the government in Westminster: “I’m proud of the strengths of the Scottish economy. We’ve seen good progress on a number of fronts, but all of them have been hampered by decisions the UK government has made. We have been particularly hard hit by the decision to remove us from the single market. Brexit has been a significant blow and is continuing to cause significant economic damage, not just to Scotland, but to the whole of the UK.”

Forbes says the SNP’s warning that Labour would continue with Tory austerity has been borne out by events. “We feel rather vindicated that within a matter of weeks of the new Labour government, we have the prime minister saying things are going to get worse before they get better and the chancellor cutting areas of spending that not even the Tories cut. It’s well known that Scotland is colder and more expensive when it comes to energy bills and so to cut universality from winter fuel payments disproportionately hits our pensioners. Not even the Tories went after the pensioners.”

As evidence of the detrimental impact Westminster can have on Scotland, Forbes could point to the decision by former chancellor Jeremy Hunt to increase duty on spirits by 10.1% from 1 August 2023.

It means the UK has the highest spirits tax of any G7 country and the fourth-highest in Europe – double that of France and quadruple the US’s, according to the Scotch Whisky Association (SWA).

The SWA says higher duty has cost HMRC almost £300m in lost revenue and is urging Rachel Reeves to reverse Hunt’s increase in her budget next month. Chief executive Mark Kent said: “It has been a calamitous decision, which has cost the Treasury money that could have been used for public services. It has stoked inflation, and it has hurt business, hospitality and households.”

But experts say Westminster cannot be solely blamed for the financial pressures that forced the Scottish government to announce £500m of spending cuts earlier this month. A report by the Scottish fiscal commission said decisions made at Holyrood – including public sector pay settlements, a council tax freeze and child support payments – had all contributed to a hole in the public finances.

Forbes has few regrets. “We are very proud to have spent more in particular policy areas: the Scottish child payment, fairer and more progressive public sector pay deals, and mitigating some of the welfare cuts from the UK government.”

Sitting in an office with commanding views over the Forth, Brown says Scotland badly needs more and better-paid work: “Some areas of Scotland have child poverty rates of 80-90%, most of it caused by low pay: 70% of children in poverty are in households where someone is working.”

Brown is still in close touch with his old constituency of Kirkcaldy and Cowdenbeath, which took in the seaside town of Burntisland, once a centre of shipbuilding. Looking at the rusting cranes in the dockyard, Brown says: “It reminds me of the 1980s.”

after newsletter promotion

The demise of shipbuilding there is, for him, a symbol of 14 wasted years that have seen a Tory government at Westminster and an SNP government in Edinburgh at loggerheads.

“Burntisland was a famous yard that had a contract to build eight wind turbines and keep 300 people in work for several years. The work went to Indonesia because the Scottish government and the UK government weren’t prepared to underwrite the contract. Burntisland sums up the failure of the past 14 years. A huge economic opportunity was lost.”

Brown insists the way forward for Scotland is to cooperate with the rest of the UK. Scottish trade with England is worth £50bn a year, almost four times its trade with the EU: “If you don’t have a relationship with the rest of Britain, how can you persuade companies to invest in Scotland?”

One big change since 2014 is that the argument over whether Scotland was receiving its fair share of North Sea oil and gas revenues has been replaced by a debate over whether it is better to exploit existing fields or leave the oil in the ground.

Gary Smith, the Scots-born general secretary of the GMB union, is sceptical about Aberdeen making a smooth transition from global centre for oil and gas to global centre for renewables. The union says thousands of offshore jobs are at risk.

Forbes says she is sympathetic to the union’s comment that you can’t shut down the industry tomorrow and tell everybody to wait 10 years for new jobs. “We know many thousands of people rely on oil and gas jobs, and that is why we have tried to take a balanced approach that prioritises the movement away from fossil fuels, but at a pace that allows companies to reinvest in renewables and us to build the infrastructure which creates the jobs and supply chain in the renewables sector.”

Smith of the GMB is not convinced: “The country is not in a good place economically. Industrial decline is ongoing. Drug deaths are through the roof. As far as levels of addiction and homelessness are concerned, I have never seen anything like it.

“Edinburgh is not Scotland. It is a mini London. Edinburgh has massive problems, with the working class increasingly pushed out of the city.

“The ying to Edinburgh’s yang is what is happening to Glasgow. When I was young there used to be a stream of traffic leaving Edinburgh for Glasgow. Now it is the other way round.”

Sebastian Burnside, the Edinburgh-based chief economist of NatWest, says: “Scotland is the region that looks most like the UK overall. It has a bit of finance, a good professional sector and still has some manufacturing. It has plenty of land and even more wind. These are the components of a well-diversified economy.”

NatWest itself has a particular place in Scotland’s recent rocky history. It was here at the Gogarburn HQ of the Royal Bank of Scotland (as NatWest was formerly known) that Fred Goodwin – Fred the Shred – built a banking empire that came crashing down in the financial crisis of 2008. RBS was within hours of going bust when it was bailed out and nationalised by Brown’s government.

Burnside says Scotland has a massive brand abroad in a way other UK regions do not. “It has heritage and history and is high up the list of places to come and visit.”

Nor he is as gloomy as Smith about the prospects for those employed in the fossil fuel sector. “Oil and gas extraction is down since 2010 but Aberdeen is not struggling. Professionals will always find work and there is a high proportion who, while not working on UK projects, are exporting their skills to the world.”

On the downside, Burnside points out that Scotland’s working-age population is at its peak, which presents a productivity challenge. “Scotland has to find a way of getting more out of its workforce, because the population is not going to be growing.”

He also cites an increasing urban-rural divide. “Cities are going to feel like pretty young places in the future but more rural places will see big moves in dependency ratios and falls in population. That’s a big challenge.”

Smith says the future of Scotland depends on what Labour delivers. Support for the SNP has collapsed and the heat has gone out of the independence debate – at least for now.

“If Labour, in power at Westminster, and possibly soon at Holyrood, can bring jobs and skilled work to Scotland, the focus will move from the constitution to the economy. If there is no upturn and austerity continues, the future of the UK will be at risk.”