Receive free UK energy updates

We’ll send you a myFT Daily Digest email rounding up the latest UK energy news every morning.

It has been a bruising summer for Britain’s net zero emissions target.

Prime Minister Rishi Sunak committed to more oil and gas licensing. Long- hoped-for changes allowing more onshore wind development fell short of expectations and Vattenfall, one of the world’s biggest offshore wind developers, put the brakes on a huge project in UK waters.

The latter received less political attention. But it is just as troubling, not least because the government intends offshore wind to replace gas-fired power stations as the backbone of Britain’s electricity system. It has set a target of 50 gigawatts of offshore wind capacity by 2030. With seven years to go, we are more than 36GW short. The Vattenfall project would have contributed 1.4GW. Not many more projects can fall by the wayside.

The news isn’t expected to get much better. Offshore wind executives have low expectations for a key renewable energy contract auction, the results of which are due on Friday. Trade bodies representing the biggest developers in the business are calling for reform of the way offshore wind is funded in Britain. Expect those calls to intensify.

Costs have rocketed by 40 per cent this year. Little that goes into making an offshore wind farm, from the turbines to the cabling, has been untouched by inflation-busting price rises.

The industry is partly to blame. In recent years it has raced to deliver projects at lower and lower prices. Developers have squeezed suppliers. Now the supply chain is not only passing on big increases in raw material and energy prices, it is also trying to recover margins.

Many of the warning signs were apparent long before Russia invaded Ukraine last year. Danish turbine maker Vestas raised a red flag about spiralling raw material and transport costs in 2021. Executives across the industry should have paid more attention.

Offshore wind companies are justified in one complaint: the prices that the UK offers developers for the energy capacity they deliver haven’t kept up with rising costs.

Each year offshore wind developers compete for government contracts that guarantee them a fixed price per unit of electricity produced once their turbines are spinning. The government sets a maximum price for each auction. Companies have to offer that price or less. They sell their output on the open market and must pay the difference to the government if the market price is higher and vice versa if it is lower.

In this year’s bidding round, the maximum price was £44 per megawatt hour in 2012 prices, closer to £60/MWh today. A quirk of renewable energy contracts is bid prices are expressed in 2012 money.

UK electricity prices are currently around £87/MWh. A similar auction in Ireland this year cleared an average of €86.05/MWh (£73.50/MWh). Companies are already lobbying about next year’s UK auction.

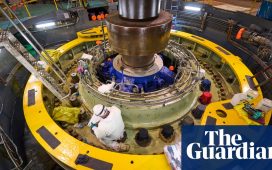

Some developers are still building projects, despite the difficult conditions. One example is Iberdrola’s 1.4GW East Anglia Three project off the Suffolk coast. But organisations such as RenewableUK, a trade body, warn Britain’s 50GW target could be in jeopardy.

One possible answer is for the government to align prices more closely to the cost of materials such as steel. Ireland is already using similar indexation. Longer-term tax incentives such as capital allowances are another.

Flint Global consultant Josh Buckland said the government could help developers by explaining well in advance how maximum bid prices will be set. Offshore wind companies complain they currently only receive information a few months before auctions open, while projects take years to develop.

In return for higher prices, ministers could demand a higher proportion of components are sourced from UK suppliers. Critics have long complained that most UK taxpayer subsidies for renewables benefit companies abroad. It would be one way for the government to ensure UK workers benefit from UK subsidies. But it is likely to mean component costs will go up.

For their part, developers could look for additional sources of funding for wind farms, such as contracts to sell the electricity to large corporations. Or they could take a bet that some of their output can be sold at higher prices on the open market, said Dan Monzani of Aurora Energy Research, a former government director of energy security.

Offshore wind companies bear some of the blame for the mess in which the industry now finds itself. But if the government wants to meet its 50GW target, it will have to accept offshore wind energy prices cannot continue to fall — the first developers to receive government contracts in 2015 were guaranteed prices of above £114/MWh. Ministers will have to meet the industry halfway if they want more turbines spinning in the North Sea.