UK competition watchdog: ‘Ground rent neither legally nor commercially necessary’

Britain’s competition watchdog has welcomed the government’s consideration of further ground rent reforms, and argues that ground rent is “neither legally nor commercially necessary”.

The Competition and Markets Authority said it “continues to consider that statutory intervention may be necessary to protect consumers from ongoing problems associated with expensive ground rents”. The government is considering capping ground rents, possibly reducing them to a nominal peppercorn, effectively zero.

There has been further progress in relation to leases where ground rent doubled more frequently than every 20 years, the watchdog said. A further three freeholders with affected Taylor Wimpey leases have taken action to remedy this:

Island Apartments Freehold Limited, Madison Close Freeholders Limited and Plaza 2 Surbiton Limited. They bought the freeholds, with onerous ground rent terms for leaseholders, from the housebuilder Taylor Wimpey.

A freeholder with affected Countryside leases, Abacus Land 1, is also taking action.

The CMA said other national house builders, Redrow, Crest Nicholson, Miller Homes and Vistry have all worked with freeholders who purchased their affected leases to secure improvements for leaseholders: Adriatic Land 3, Abacus Land 4, RMB 102 Limited, and Space in London Limited.

The CMA said:

We do not intend to open any new ground rent cases or cases related to the mis-selling of leasehold homes at this stage. However, existing cases remain open. We will consider next steps in those cases in light of the government’s decision whether to cap ground rent.

In its response to the government’s ground rent consultation, the watchdog said:

We had a particular concern with so-called “modern leaseholds” that emerged in the 2000s, where ground rent often doubled periodically or increased by RPI [retail prices index] in leases that normally lasted for 125 years or more, notwithstanding that a substantial premium had been paid on purchase. In those leases ground rent was neither legally necessary nor did we see any persuasive evidence that it was commercially necessary. In fact we heard no convincing justification for the payment of any ground rent in modern leaseholds…

It is possible that the inclusion of doubling clauses in leases may in some cases have been stimulated by investors.

There has been a lengthy battle to reform the “feudal” leasehold system in England and Wales, and housing secretary Michael Gove’s proposal to reduce existing ground rents to zero, have met with fierce opposition from freehold groups.

The CMA went on to say:

It is clear to us from our investigation that ground rent can cause a wide range of problems including, but not limited to, circumstances in which lease terms are likely to be unfair and unlawful under consumer protection law.

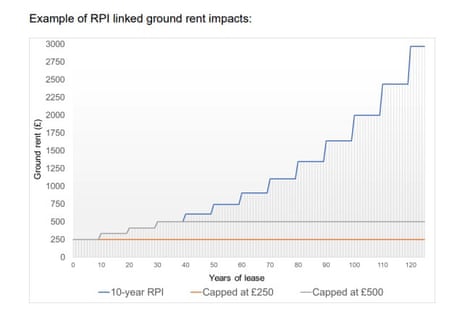

Here’s an example of how ground rent linked to inflation (RPI) could soar, if RPI averages 3% over the first 10 years and 2% thereafter, from the watchdog’s report.

The CMA concludes:

Our conclusion was that ground rent was neither legally nor commercially necessary, and we saw no persuasive evidence that consumers receive anything in return.

We can also see that the UK government’s broader view that the housing market has to be modernised, and released from anachronistic practices, is a highly relevant consideration in its decision-making. The UK government will of course receive evidence on the costs and consequences to freeholders and investors from caps of different forms and will take those considerations into account.

Key events

Virgin Group cutting 32 HQ jobs; Branson in line for £400m from Virgin Money stake

Sir Richard Branson’s Virgin Group is cutting dozens of jobs at its London base, as it is combining two of his companies.

Sky News reported that Virgin Group plans to cut 32 jobs in its head office, laying off 8% of the 425 people who work there. The company has decided to combine its brand and licensing arm Virgin Management with its loyalty programme Virgin Red.

Branson could receive more than £400m from the potential sale of his minority stake in Virgin Money, which was co-founded by the billionaire in 1995.

Nationwide building society last week struck a surprise deal to acquire the high street bank for nearly £3bn, with Virgin Group reportedly set to receive a £250m exit fee when its brand disappears from the combined group.

BP, Abu Dhabi pause $2bn bid to buy stake in Israel’s NewMed Energy

Jillian Ambrose

BP and the United Arab Emirates state oil company have paused their $2bn bid to buy a major stake in Israel’s NewMed Energy due to the “uncertainty” created by the ongoing war in Gaza.

Shares of NewMed, which is owned by the Delek Group, fell by as much as 8% in Tel Aviv after the company said talks with BP and the Abu Dhabi National Oil Company (Adnoc) had been suspended “due to the uncertainty created by the external environment”.

The deal to buy a 50% stake in the company was announced in March last year and marked the burgeoning financial ties between the UAE and Israel as political relations in the region began to normalise. However, Israel’s war in Gaza following the 7 October Hamas attack has upended geopolitics in the region and reignited tensions between Israel and its neighbours.

NewMed said that the deal would remain suspended “until such time as discussions resume or the process is terminated”. It added that there was “no certainty that discussions will resume or that an agreement will be reached in the future”.

Regarding the battle to reform the outdated leasehold system in England and Wales, in particular ground rents, the Leasehold Knowledge Partnership, a group representing leaseholders, said:

Ground rents have always been just an additional profit scheme from the developers and those who buy ground rent income streams on a speculative basis.

The developers and freeholders entered into a government pledge to limit ground rents in 2019. It has taken a lot of work from the CMA to force more developers and freeholders to finally meet that pledge five years later.

Analysts at Jefferies have looked at the new offer from Ageas:

With a second offer from Ageas valuing Direct Line at only 237p, the prospects of a bid reaching our expectation of 270p-300p are receding. This second offer is only +3% higher than the first offer, in part because the implied value of the first offer has fallen -1%.

One redeeming feature about the offer is that the cash component has been lifted +20% from 100p to 120p. However, this is offset by reducing the amount of shares in Ageas being offered, with the ratio deteriorating from 1 new Ageas share per 25, to 1 per 28. In essence, Ageas are shifting the value from shares to cash, with the total value only slightly rising.

Unsurprisingly, given the strength of management’s pushback to the initial offer, this second offer has also been unanimously rejected.

Direct Line rejects latest £3.1bn proposal from Ageas

Direct Line has rejected a second takeover approach from the Belgian insurer Ageas, which values it at nearly £3.1bn, as too low.

The UK insurer said its board had unanimously rejected the latest proposal, which it described as a “highly conditional, non-binding indicative proposal”.

Ageas offered to pay 237p a share, up 3% from its previous proposal of 231p a share.

Direct Line shares fell 5.7% to 212.8p on the news.

The company said:

The board is confident in Direct Line Group’s standalone prospects. Direct Line Group will release its 2023 preliminary results on Thursday 21 March and will also then provide an update on further initiatives to build on the operational improvements implemented during 2023.

Under UK takeover rules, Ageas has until 5pm on 27 March to make a firm offer or walk away.

UK competition watchdog: ‘Ground rent neither legally nor commercially necessary’

Britain’s competition watchdog has welcomed the government’s consideration of further ground rent reforms, and argues that ground rent is “neither legally nor commercially necessary”.

The Competition and Markets Authority said it “continues to consider that statutory intervention may be necessary to protect consumers from ongoing problems associated with expensive ground rents”. The government is considering capping ground rents, possibly reducing them to a nominal peppercorn, effectively zero.

There has been further progress in relation to leases where ground rent doubled more frequently than every 20 years, the watchdog said. A further three freeholders with affected Taylor Wimpey leases have taken action to remedy this:

Island Apartments Freehold Limited, Madison Close Freeholders Limited and Plaza 2 Surbiton Limited. They bought the freeholds, with onerous ground rent terms for leaseholders, from the housebuilder Taylor Wimpey.

A freeholder with affected Countryside leases, Abacus Land 1, is also taking action.

The CMA said other national house builders, Redrow, Crest Nicholson, Miller Homes and Vistry have all worked with freeholders who purchased their affected leases to secure improvements for leaseholders: Adriatic Land 3, Abacus Land 4, RMB 102 Limited, and Space in London Limited.

The CMA said:

We do not intend to open any new ground rent cases or cases related to the mis-selling of leasehold homes at this stage. However, existing cases remain open. We will consider next steps in those cases in light of the government’s decision whether to cap ground rent.

In its response to the government’s ground rent consultation, the watchdog said:

We had a particular concern with so-called “modern leaseholds” that emerged in the 2000s, where ground rent often doubled periodically or increased by RPI [retail prices index] in leases that normally lasted for 125 years or more, notwithstanding that a substantial premium had been paid on purchase. In those leases ground rent was neither legally necessary nor did we see any persuasive evidence that it was commercially necessary. In fact we heard no convincing justification for the payment of any ground rent in modern leaseholds…

It is possible that the inclusion of doubling clauses in leases may in some cases have been stimulated by investors.

There has been a lengthy battle to reform the “feudal” leasehold system in England and Wales, and housing secretary Michael Gove’s proposal to reduce existing ground rents to zero, have met with fierce opposition from freehold groups.

The CMA went on to say:

It is clear to us from our investigation that ground rent can cause a wide range of problems including, but not limited to, circumstances in which lease terms are likely to be unfair and unlawful under consumer protection law.

Here’s an example of how ground rent linked to inflation (RPI) could soar, if RPI averages 3% over the first 10 years and 2% thereafter, from the watchdog’s report.

The CMA concludes:

Our conclusion was that ground rent was neither legally nor commercially necessary, and we saw no persuasive evidence that consumers receive anything in return.

We can also see that the UK government’s broader view that the housing market has to be modernised, and released from anachronistic practices, is a highly relevant consideration in its decision-making. The UK government will of course receive evidence on the costs and consequences to freeholders and investors from caps of different forms and will take those considerations into account.

January GDP growth boosted by private healthcare

The Office for National Statistics has confirmed that the boost to the health sector in January was driven by private health providers.

Despite the impact of strikes, such as the junior doctors’ continued industrial action in January, the health sector grew by 0.9% in January from the previous month. This is because long NHS waiting lists drove more people into private healthcare.

See previous post.

Morrisons makes £1bn loss after debt-fuelled private equity buyout

Morrisons made a loss of more than £1bn last year in part because of the rising cost of debts incurred during a private equity takeover in 2021.

The UK’s fifth-largest supermarket had to pay finance costs of £735m, up from £590m the year before, according to its latest annual accounts for the year to 29 October.

It was the second consecutive year in which the supermarket lost more than £1bn, after reporting a loss before tax of £1.5bn in 2022.

The chain was bought by US private equity investor Clayton, Dubilier & Rice (CD&R) in October 2021, in a deal that marked a move away from the ethos of Sir Ken Morrison, who built the company up from his father’s market stall in Bradford.

Morrisons’ net debt obligations were £3.2bn before the CD&R takeover. The parent company – a legacy of the takeover called Market Topco – reported that net debts at the end of 2023 rose to £8.6bn.

As the company’s debt pile has grown it has also had to contend with rapidly changing conditions. Since the takeover interest rates have soared, resulting in increasing debt servicing costs.

The cost of living crisis and the global energy crisis have also had an impact on British shoppers, while Morrisons has faced stiff competition from German discounters Aldi and Lidl. Aldi overtook Morrisons as the fourth-largest supermarket in the UK in 2022.

Rami Baitiéh, who took over from David Potts as the chief executive of Morrisons in November, has said the company will try to listen to customers more as it tries to turn around its fortunes.

UK GDP on track to exit recession in Q1 – Investec

Britain’s economic growth in January was mainly driven by a 3.4% rise in retail sales, and a 1.1% rebound in construction output.

Sandra Horsfeld, UK economist at Investec, has crunched the numbers.

Set against that, manufacturing output flatlined after two months of gains. According to the ONS, the latter appears linked in part to supply chain disruptions related to the war between Israel and Hamas. This has seen shipping rerouted to avoid the Red Sea, adding to delivery times and costs for some goods. This seems to have had some direct impact on wholesale trade and warehousing, as well as indirect negative effects for some parts of the manufacturing sector.

As in previous months, the ONS cited strikes, including the stepping up of industrial action by junior doctors to six days in January from three days in December, as another possible brake on output. However, we note that human health activities nevertheless saw a rise in gross value added of 0.9% month-on-month, which the ONS said was ‘mainly caused by growth in the market sector’.

She wonders whether this was a boost from private healthcare, as long NHS waiting lists prompted more people to to turn to private treatments.

We wonder whether this reflects the postponement of NHS medical procedures driving more patients into private healthcare instead, and a different treatment of the latter in the statistics as only private healthcare has a market price charged to the patient and/or his insurer.

Horsfeld added:

More generally, the key takeaway to us from today’s GDP data is that the healthy if unspectacular overall gain in January left the level of output the highest since September 2023. Therefore, even with zero further growth in February and March – an unlikely outcome, given rises in household real disposable incomes reflecting above-inflation wage gains, few job losses and also lower rates of employee National Insurance Contributions – the economy is on track to have exited its shallow technical recession of H2 2023 already as of Q1. Of course, this assessment could yet change, in particular were there to be downward revisions to back data in subsequent releases.

Turning to the outlook for interest rates, she said:

A natural question might be how the Bank of England will perceive these numbers. We do not see a major impact. The baseline forecast in the February Monetary Policy Report (MPR) had been for 0.1% GDP growth in Q1. That looks somewhat too low to us; we have pencilled in +0.3%. However, the MPR had not anticipated the 0.3% quarterly contraction in GDP in Q4 2023 (the forecast was for zero growth).

In the round, therefore, the level of output may not be all that different from the MPC’s expectations. Instead, it is inflation and labour market outturns that will likely be most crucial in shaping the rate path. And in this respect, we see enough signals to warrant a first move lower in the Bank rate before long: our forecast remains for an initial rate cut in June, and 75bps of cuts in total in 2024, with more to follow in 2025.

Here’s our full story on Metro Bank.

Metro Bank is cutting 1,000 jobs and putting an end to its trademark seven-day branch model, after nearly tripling the size of its cost cutting plan in the wake of its autumn rescue deal.

The lender said on Wednesday that it had expanded an original £30m cost savings plan first announced in October to £50m – after axing about 200 more staff than it had initially aimed for – and now planned to slash a further £30m in costs by the end of the year, bringing its total savings to £80m.

Its chief executive, Daniel Frumkin, said the bank was considering further job cuts and would scale back its seven-days-a-week opening model across its 76 branches from April. That will include closing on Sundays, reducing daily hours in some branches and moving some to five-days-a-week openings.