UK consumer confidence sinks to new low

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

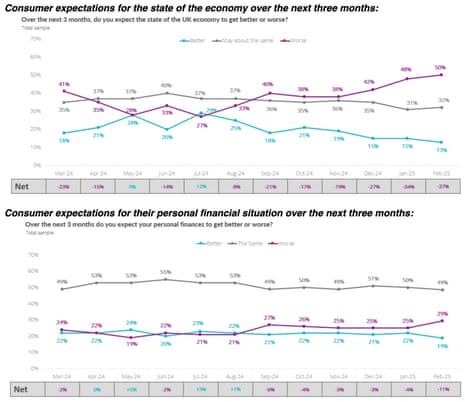

Confidence among UK consumers has dropped off a cliff since last summer, as people – particularly women – grow more worried about the state of the economy, and their own finances.

A new survey from the British Retail Consortium (BRC) and Opinium has found that the public’s expectations for the economy worsened for a fifth month running in February,

Households are also gloomier about their own personal finances, as they anticipate further price rises in the shops – as retailers pass on higher taxes.

February’s drop in confidence continues a decline that started last July, when the Labour party won the general election – and swiftly began warning about ‘tough choices’ and ‘painful decisions’ to fix the country’s finances.

Last October’s budget, with its increase in the national insurance contributions (NICs) paid by businesses, appears to have also hit confidence.

Helen Dickinson, chief executive of the British Retail Consortium, explains:

“People’s expectations of the economy reached a new low, having fallen almost 40pts since July 2024.

Even Gen Z (18-27), the most upbeat generation on the economy and their own finances, saw a drop off in optimism. There was also a widening gender divide in confidence this month, with women more pessimistic than men about both the economy and their own finances by 13 and 17pts respectively.

With many businesses warning of the impact that April’s employer NIC’s increase will have on hiring, and the rising energy price cap pushing up the cost of domestic bills, it is little surprise that many households are worried. And while there was a positive increase in expectations of personal retail spending, this may be largely driven by the expectations of higher prices in the future.

Here’s the details of the survey:

-

The state of the economy worsened to -37 in February, down from -34 in January. This is the fifth consecutive month in which expectations have worsened.

-

Their personal financial situation dropped to -11 in February, down from -4 in January.

-

Their personal spending on retail rose to -5 in February, up from -9 in January.

-

Their personal spending overall remained at +4 in February, the same as in January.

-

Their personal saving remained at -3 in February, the same as in January.

Dickinson suggests consumers are correct to anticipate higher prices:

“Expectations of higher prices are not unfounded, with two-thirds of retailers saying prices will have to rise as a result of the £7bn in additional costs, including higher employer NICs and a new packaging levy. Almost half of retailers also warned of hiring freezes, with entry-level jobs often among the first to go as they seek any cost efficiencies to help them protect customers from the worst of the rising costs.

As the Government bill on the future of business rates progresses through Parliament, it is essential that no shop ends up paying more in rates as a result of these reforms, otherwise retailers will face a triple whammy of Budget costs, business rates rises, and new packaging and recycling levies, all of which will filter through to consumer prices.”

The agenda

-

11am CBI industrial trends report

-

1.30pm US initial jobless claims data

-

3pm Eurozone consumer confidence report for February

Key events

Centrica profits slump

Jillian Ambrose

The owner of British Gas has reported a slump in its annual profits after the supplier was ousted as Britain’s largest provider of gas and electricity for the first time last year.

The supplier’s parent company, Centrica, reported adjusted earnings of £2.3bn for last year, down by a third from 2023 when its profits reached £3.5bn after a £500m windfall from the energy regulator.

Ofgem allowed all suppliers to recover the unexpected costs of the energy crisis in the first half of 2023 by adjusting the energy price cap, which helped British Gas to a profit of £751m.

The household supplier’s operating profit slumped to £297m last year, but Centrica said that excluding the impact of the one-off Ofgem allowance meant its performance was “relatively comparable” to the year before.

Centrica also announced a new £500m share buyback programme, news which has helped push its shares up by 10% iin early trading.

Britain’s economic woes mean busy times for those who handle failing businesses.

Begbies Traynor, the UK’s largest insolvency practitioner, reported this morning it has a “strong pipeline” of business.

Ric Traynor, executive chairman of Begbies Traynor, says:

“We have maintained the strong performance reported at the half year, and continue to see encouraging activity levels and positive momentum across the group.

With recent reports of rising insolvencies and business financial distress, market conditions remain supportive. We therefore continue to invest in and develop our teams to take advantage of opportunities for growth.”

Here’s our news story on Lloyds’s rising potential compensation bill from the motor finance scandal:

Anglo American takes $2.9bn De Beers writedown

Mining giant Anglo American has written down the value of its struggling De Beers diamond unit by $2.9bn, as it continues to seek a buyer for the division.

Anglo blamed “prevailing diamond market conditions” for its decision to cut the carrying value of De Beers again, on top of a $1.6bn writedown a year ago.

Last year, when it was rebuffing a takever approach from rival BHP, Anglo announced it would spin off De Beers.

That sale, though, has been hampered by poor conditions in the diamond market, due to weak demand from China, cautious consumers, and the rise of lab-grown diamonds.

Today, Anglo says:

“The work to separate De Beers is well under way, with action taken to strengthen cash flow in the near term and position De Beers for long-term success and value realisation.”

The De Beers impairment helped to pull Anglo into the red last year – this morning it reported a loss attributable to equity shareholders of $3.1bn.

After writing down the value of its diamond subsidiary De Beers by $1.6 billion in 2024, now mining giant Anglo American is taking a further $2.9 billion impairment. Difficult to see how Anglo can monetise its diamond business — as it has promised to shareholders. 💎⛏️

— Javier Blas (@JavierBlas) February 20, 2025

Shares in Lloyds have jumped over 2% in early trading, despite this morning’s profits miss.

Investors may be cheered that Lloyds has announced a new £1.7bn share buyback programme, to return excess capital to shareholders.

Matt Britzman, senior equity analyst at Hargreaves Lansdown, says LLoyd’s £700m motor finance charge has ‘tarnished’ a strong final quarter:

“Lloyds has capped off a strong year with a clouded fourth-quarter result, setting aside a hefty £700m provision for potential charges related to the ongoing motor finance saga. While you could argue the provision is overly cautious, Lloyds holds the largest exposure of any major UK bank, and the outcome remains uncertain. Despite this, the stock is up over 40% in the past year, reflecting a solid banking outlook and robust performance.

Beneath the surface, Lloyds is delivering strong results. Excluding the motor finance charge, fourth-quarter figures exceeded expectations, thanks to borrowers performing better than anticipated. Remarkably, Lloyds has managed to improve its loan quality over the course of the year, defying fears that borrowers would buckle under the pressure of persistent inflation.

Lloyds sets aside another £700m for motor finance scandal

Lloyds profits were hit by rising costs from the motor finance scandal.

The bank has put aside another £700m to cover possible compensation from customers caught up in the car loans commission scandal, in which lenders paid a “secret” commission to the car dealers who had arranged a loan for a buyer.

LLoyds CEO Charlie Nunn says:

In the fourth quarter we took an additional £700 million provision for the potential remediation costs relating to motor finance commission arrangements.

This is in light of the Court of Appeal judgment on Wrench, Johnson and Hopcraft that goes beyond the scope of the original FCA motor finance commissions review.

Wrench, Johnson and Hopcraft are the three consumers who won a Court of Appeal hearing over motor dealers acting as credit brokers in arranging hire-purchase agreements for car buyers, and whether lenders are liable in cases of undisclosed or “partially disclosed” commission.

LLoyds has now set aside £1.15bn in provisions for motor finance compensation, but warns today there is “a significant level of uncertainty in terms of the final outcome”.

LLoyds profits fall 20%

Lloyds Banking Group, which is something of a bellwether for the UK economy, has missed City expectations this morning by reporting a 20% drop in profits last year.

Lloyds reported a pre-tax profit of £5.97bn for 2024, a fifth lower than the £7.5bn it made in 2023.

Analysts had expected profits of around £6.4bn.

Income was hit by a lower “lower banking net interest margin”, as interest rate cuts ate into lending margins at the UK’s largest high street lender.

It has also run up higher remediation and impairment charges (of which more in a moment…)

Lloyds reports that its loans and advances to customers rose by £10.2bn to £459.9bn last year, including £6.1bn growth in UK mortgages.

Customer deposits “significantly increased” in the year by £11.3bn, to £482.7bn.

And encouragingly, Lloyds has improved its economic outlook, following recent house price growth and after assessing the risks from inflation and interest rates.

UK consumer confidence sinks to new low

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

Confidence among UK consumers has dropped off a cliff since last summer, as people – particularly women – grow more worried about the state of the economy, and their own finances.

A new survey from the British Retail Consortium (BRC) and Opinium has found that the public’s expectations for the economy worsened for a fifth month running in February,

Households are also gloomier about their own personal finances, as they anticipate further price rises in the shops – as retailers pass on higher taxes.

February’s drop in confidence continues a decline that started last July, when the Labour party won the general election – and swiftly began warning about ‘tough choices’ and ‘painful decisions’ to fix the country’s finances.

Last October’s budget, with its increase in the national insurance contributions (NICs) paid by businesses, appears to have also hit confidence.

Helen Dickinson, chief executive of the British Retail Consortium, explains:

“People’s expectations of the economy reached a new low, having fallen almost 40pts since July 2024.

Even Gen Z (18-27), the most upbeat generation on the economy and their own finances, saw a drop off in optimism. There was also a widening gender divide in confidence this month, with women more pessimistic than men about both the economy and their own finances by 13 and 17pts respectively.

With many businesses warning of the impact that April’s employer NIC’s increase will have on hiring, and the rising energy price cap pushing up the cost of domestic bills, it is little surprise that many households are worried. And while there was a positive increase in expectations of personal retail spending, this may be largely driven by the expectations of higher prices in the future.

Here’s the details of the survey:

-

The state of the economy worsened to -37 in February, down from -34 in January. This is the fifth consecutive month in which expectations have worsened.

-

Their personal financial situation dropped to -11 in February, down from -4 in January.

-

Their personal spending on retail rose to -5 in February, up from -9 in January.

-

Their personal spending overall remained at +4 in February, the same as in January.

-

Their personal saving remained at -3 in February, the same as in January.

Dickinson suggests consumers are correct to anticipate higher prices:

“Expectations of higher prices are not unfounded, with two-thirds of retailers saying prices will have to rise as a result of the £7bn in additional costs, including higher employer NICs and a new packaging levy. Almost half of retailers also warned of hiring freezes, with entry-level jobs often among the first to go as they seek any cost efficiencies to help them protect customers from the worst of the rising costs.

As the Government bill on the future of business rates progresses through Parliament, it is essential that no shop ends up paying more in rates as a result of these reforms, otherwise retailers will face a triple whammy of Budget costs, business rates rises, and new packaging and recycling levies, all of which will filter through to consumer prices.”

The agenda

-

11am CBI industrial trends report

-

1.30pm US initial jobless claims data

-

3pm Eurozone consumer confidence report for February