Stay informed with free updates

Simply sign up to the UK house prices myFT Digest — delivered directly to your inbox.

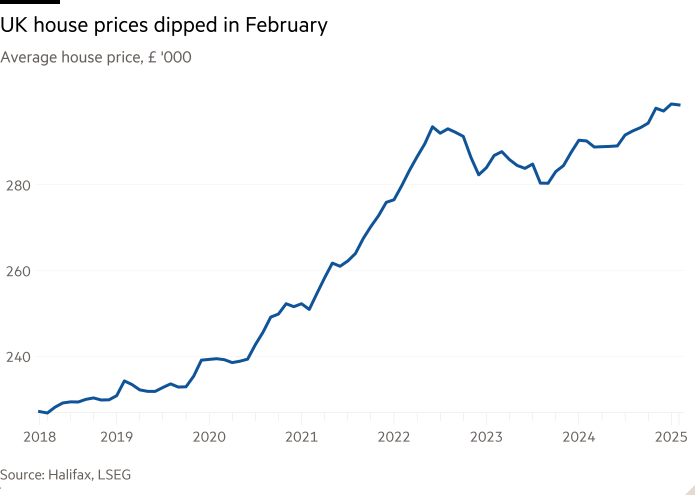

UK house prices unexpectedly dipped in February, as an uptick in property sales driven by a stamp duty holiday came to an end, according to mortgage lender Halifax.

In February, the average UK house price fell 0.1 per cent from January to £298,602, Halifax said. On an annual basis, the average price rose at a rate of 2.9 per cent, the same rate as January.

The price changes were below forecasts. Economists polled by Reuters had forecast 0.3 per cent month on month growth and a 3.1 per cent annual rise.

Amanda Bryden, head of mortgages at Halifax, said the figures demonstrated a “delicate balance” in the UK house market.

“While there’s been talk of a last minute rush on new mortgages ahead of the changes to stamp duty, inevitably we’ve seen some of the demand that was brought forward start to fade as the April deadline ticks closer, given the time needed to complete a purchase,” she said.

The current stamp duty holiday was announced in September 2022 when mortgage rates were rapidly rising, and remains in place until March 31.

From April, first-time buyers, for example, will start paying the levy on purchases of £300,000 or more, rather than £425,000 at present.

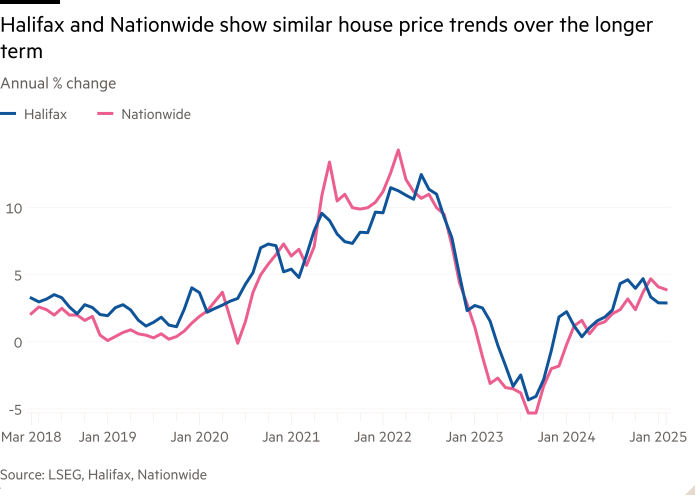

Friday’s figures contrast with data last week from mortgage lender Nationwide, that indicated that the average house price rose more than expected in February, by a monthly rate of 0.4 per cent.

Halifax has a larger sample than Nationwide, with about 15,000 transactions compared with 12,000, and a focus on northern regions that can generate short-term differences.

However, both Nationwide and Halifax showed that house prices surged during the pandemic, contracted as mortgage rates rose over the past two years, and recovered in 2024.

Ashley Webb, economist at the consultancy Capital Economics, said that the dip in house prices shown by Halifax suggested that rising mortgage rates, coupled with weakness in the economy as a whole, “is weighing on housing demand and prices a bit more than we previously thought”.

He added that the worsening outlook in the jobs market — which some economists and businesses say has been hit by the Labour government’s increase of national insurance contributions by employers — “may mean house price growth softens further over the coming months”.

Mortgage rates have been volatile over the past year, reflecting changing investor expectations of how much the Bank of England will cut borrowing costs this year. Despite an uptick in recent months, mortgage rates remain below their peak reached in the summer of 2023.

Halifax reported that house prices in Northern Ireland continued to rise at the fastest annual pace in the UK, up 5.9 per cent to an average of £205,784.

London remained the most expensive property market with an average property price of £545,183, but with the slowest annual increase at 1.6 per cent.

Affordability continues to be stretched, said Bryden. But she added that the “shortage of housing supply coupled with sustained demand suggests property prices will continue to rise this year, albeit at a more measured pace compared to last year”.