Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

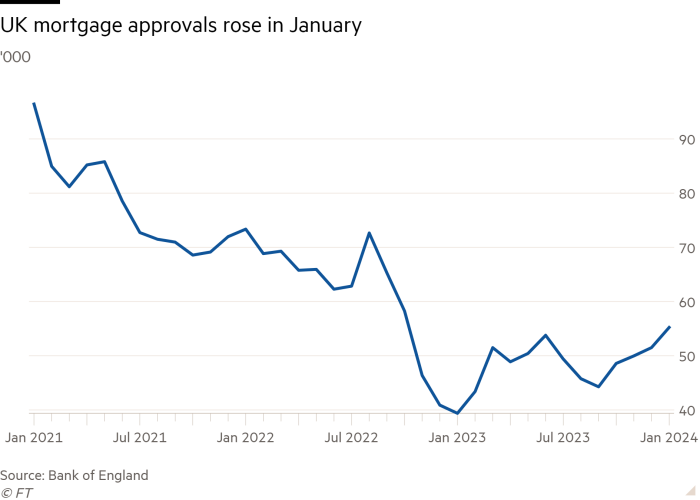

UK mortgage approvals in January rose much more than expected, reaching their highest level since October 2022 as borrowing costs fell, according to data by the Bank of England that points to a recovery in the property market at the start of the year.

Net mortgage approvals for house purchases rose from 51,500 in December to 55,200 in January — the highest in 15 months and above the 52,000 forecast by economists polled by Reuters.

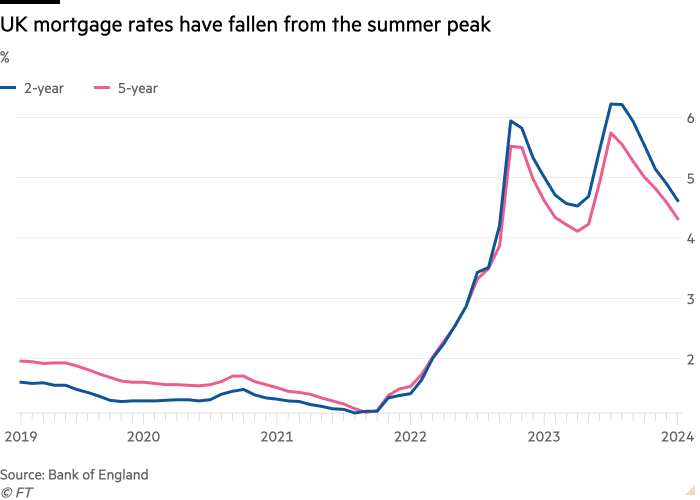

The BoE said January’s “effective” interest rate — a measure of the weighted average cost — on newly drawn mortgages fell 9 basis points, to 5.19 per cent. This marked the second consecutive monthly fall in the rate, taking it to its lowest since October 2023.

The data, a snapshot of the health of the housing market, suggests the residential market is recovering as the squeeze from higher borrowing costs seen over the past two years eased.

The BoE also released figures that showed consumer credit rose more than expected to £1.9bn in January, from £1.3bn in the previous month, adding to signs of a revival in spending.

Economists said the improved data should help a wider economic rebound after the UK slipped into recession at the end of last year.

Ashley Webb, an economist at Capital Economics, said the BoE figures suggested “the drag on consumer spending and the housing market from higher interest rates [was] easing”, adding: “The recession will be over soon if it’s not already.”

The average quoted mortgage rate for a two-year fixed deal with a loan-to-value ratio of 60 per cent eased to 4.62 per cent in January from 4.9 per cent in the previous month and the lowest since April 2023, according to the BoE. Rates on three-year and five-year fixes also continued to fall.

Mortgage rates have fallen from their summer peak in anticipation that the BoE would begin to cut interest rates this year from the 16-year high of 5.25 per cent.

Sticky services inflation and strong wage growth data in February, however, led to some readjustment of interest rate expectations in the markets, prompting some mortgage lenders to push up borrowing costs slightly.

In the past few weeks, “rates have gone up a little and it’s caused some people to pause as doubt sets in over the stability of this recovery”, said Rita Kohli, managing director, at the broker The Mortgage Stop.

But Tom Bill, head of UK residential research at Knight Frank, said he expected demand would “get stronger as inflation [came] under control” and forecast house prices would rise by 3 per cent this year.