The UK steel industry has called for the government to promise to buy British as it prepares for a major expansion of offshore wind generation.

Wind generation has become a key part of the UK’s energy system, contributing 29% of generated electricity in 2023. However, despite the huge increase in the number of turbines, only 2% of the steel used in British offshore wind projects over the past five years was made in the UK, according to a study by the consultants Lumen Energy & Environment, commissioned by UK Steel, a lobby group.

The British industry wants the government to aim to dramatically increase that proportion. The business secretary, Jonathan Reynolds, is preparing to publish a new steel strategy in the spring that will look at how to “increase steel capacity and capability in the UK” even as the industry struggles with the costs of decarbonising.

Gareth Stace, the UK Steel chief executive, said there was a “great opportunity” in offshore wind, but the industry wanted the Labour government to pledge to favour British-made steel in its procurement.

Demand for steel in Britain’s offshore windfarms is due to rise rapidly to more than 1m tonnes a year on average over the 2026 to 2050 period, peaking at more than 2m tonnes, according to Lumen. That compares with about 300,000 tonnes a year for the 2021-25 period.

However, much of that forthcoming demand will be for plate steel, which is not now made at sufficient scale in the UK. Making more in the UK would require investment from private companies that may not be forthcoming without a government pledge to favour British products.

Stace argued that filling in the gap in offshore wind should be an important part of the strategy because of the scale of planned UK government procurement. Lumen’s report said that demand for steel for offshore wind up to 2050 would be nearly six times greater than the steel required by UK defence, highways, rail and government buildings combined.

Products from abroad tend to be cheaper than British-made steel, partly because of higher energy costs. However, UK Steel argued that the government should be prepared to spend more if Britain retained more of the benefit of the spending, rather than sending money abroad.

“Are you just applying cost, or are you applying value?” Stace said. He added that “steel from the UK should be considered, and considered by default” in government procurement.

after newsletter promotion

Reynolds has said the government wanted to reverse the decline of the UK steel industry, including via a £2.5bn fund for investment in the sector. Some of that cash has already been committed to Tata Steel’s plan to swap polluting blast furnaces for electric arc furnaces at Port Talbot in south Wales, while another chunk may go on doing the same at Chinese-owned British Steel, amid talks over the future of its plant at Scunthorpe.

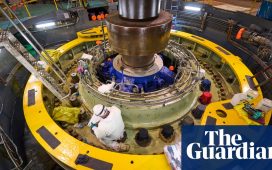

For offshore wind, steel plate is bent into the tubes that form turbine towers, the piles that are sunk into the sea bed, or the jacket structures used for deeper water.

The UK has had some success in retaining value from the manufacture of wind turbines. The Smulders site at Newcastle upon Tyne assembles components, while in Teesside SeAH is nearing completion of the world’s largest factory for the monopiles that fix turbines to the sea bed. However, those factories will rely on imported steel.