Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

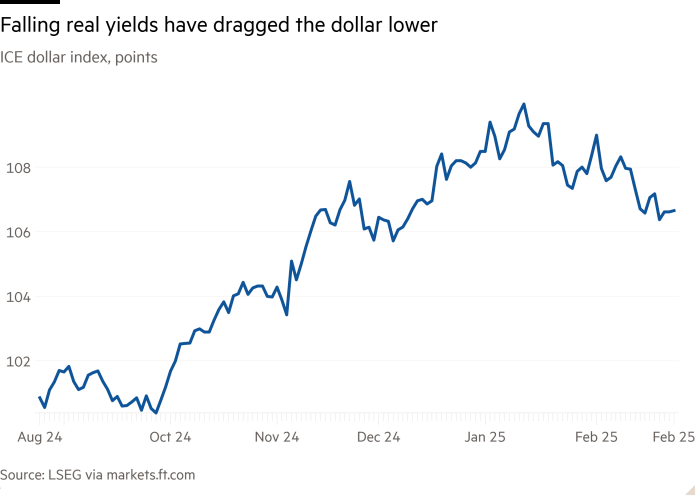

A fall in US bond yields is piling pressure on the dollar, as investors bet that slowing economic growth will push the Federal Reserve to keep cutting interest rates despite persistent inflation.

The 10-year Treasury yield fell to 4.32 per cent on Tuesday, the lowest level since mid-December. The decline from above 4.8 per cent last month has been prompted by a worsened outlook for US growth, after a string of data showed weak consumer and business sentiment.

That has hit the dollar, which is now down 1.9 per cent this year against a basket of its peers, confounding expectations that Donald Trump’s return to the White House would continue to bolster the currency. The dollar had previously strengthened on bets that the inflationary effect of the new president’s tariffs and immigration curbs would prevent the Fed from cutting rates.

“Slowing growth and higher inflation expectations is a more negative mix for the US dollar,” said Lee Hardman, senior currency analyst at banking group MUFG.

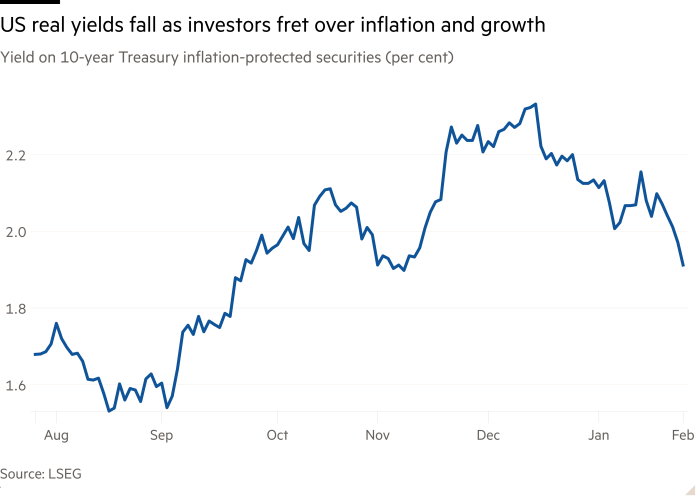

Investors say the fall in real Treasury yields, which represent the return on offer after inflation is taken into account, has been a particularly significant driver of the currency.

The yield on 10-year Treasury inflation-protected securities (Tips) fell to 1.9 per cent on Tuesday, the lowest since early December and down from 2.3 per cent last month.

Persistent inflationary pressures have put the Fed in a bind, as it would naturally respond by slowing or ending its rate-cutting cycle, or even signal rate rises. But flagging growth — and repeated broadsides from Trump demanding that Fed chair Jay Powell lower borrowing costs — are pushing in the other direction.

Trump initially sharply criticised the Fed after it held rates last month, but later said it was “the right thing to do”.

JPMorgan analysts highlighted in a note last week the “significant erosion of US real yields [due] to unresponsive Fed policy in the face of a sharp tariff-induced surge in front-end inflation”.

Near-term inflation expectations have climbed as investors price in the likely impact of Trump’s tariffs. So-called two-year break-evens — which measure the difference between real yields and nominal yields and are investors’ best guess on where inflation is headed — last week reached their highest since early 2023.

US inflation unexpectedly increased to 3 per cent in January and the latest Fed minutes warned of the “upside risk” for inflation. Consumer expectations of long-term price rises are at their highest since 1995.

Even so, investors are betting the Fed will lower rates by a further half percentage point by the end of the year.

Fund managers said the market was taking a dimmer view of the threat to domestic growth from the stop-start trade war launched by the new president, as well as other policies such as an immigration crackdown and sweeping job cuts in the public sector.

Nominal US Treasury yields have also fallen sharply since their peak in mid-January.

“Markets are asking if we have seen peak US exceptionalism,” said Matthew Morgan, head of fixed income at Jupiter Asset Management, adding that uncertainty over the path of monetary policy, as well as tariffs, government cuts and other areas, “may mean less investment, hiring and growth”.

Besides the weaker dollar and lower yields, he said, “the next question will be whether a repricing of US growth leads to a repricing of risk assets”. After hitting a series of record highs, stocks have lost ground in recent sessions.

An S&P survey of purchasing managers published last week showed the US services sector had contracted for the first time in more than two years.

UBS analysts said earlier this month that falling real yields, while inflation expectations remained high, reflected a “stagflationary impulse” from tariffs.